AVIOR INSIGHTS – Why Market Cycles and Short-Term Swings Are a Normal Part of Investing

Many investors face the constant struggle of wondering whether the rules of investing have changed. This is especially true today given how much has evolved over the past two years. Investors are adjusting to a new economic landscape of higher inflation, rising interest rates, and tighter Fed policy. Different parts of the market have swung wildly throughout the pandemic recovery, including tech stocks, energy, bonds, crypto, and more. It can be difficult to judge whether these developments change the nature of investing or reflect normal market behavior. In these situations, how can investors stay focused on the core principals of investing?

As the saying goes, those who don’t learn from history are doomed to repeat it. For investors, perhaps the most important historical lesson for the economy and financial markets is that both operate in cycles. There are well documented booms and busts across centuries in addition to those that investors have experienced over the past few decades. However, it’s also the case that markets fluctuate within cycles, making it difficult to judge whether a large market swing is a true turning point or a temporary event.

This matters because some investments are simply more prone to big booms and busts. Technology, for instance, often makes bold promises of reshaping the future. In the cases when these promises are realized, it seems silly to have focused on earnings or valuations in hindsight. The same argument has been made for cryptocurrencies, artificial intelligence, financial technology, and many other sectors. It often feels as if these claims are accelerating alongside technological advancement.

However, the reason to focus on fundamentals is exactly because it is difficult to predict the exact winners. The transformative nature of technology is exciting but also a reason it is difficult to forecast its impact. Trying to predict the tech winners in the late 1990s, among the thousands that did not survive, would have been quite a feat. Instead, using a disciplined portfolio approach allows investors to take advantage of these trends while protecting from downside.

Additionally, it can be argued that the impact of the information technology revolution of the past two decades was felt across the entire economy. There is no major corporation today that is not heavily dependent on digital technology, and many “technology” companies are now found across market sectors beyond Information Technology, including Communication Services and Consumer Discretionary. This has helped to boost productivity and increase profit margins via digitization, automation, and more. Thus, focusing on only a single stock or industry doesn’t quite capture the true impact of transformational technologies.

Of course, market prices and valuations can deviate from fundamentals for quite a while, as was the case recently. Trying to get the timing right is nearly impossible, and being too early is often the same as being wrong. Today, the stock market is still well above its levels both prior to the pandemic and at most points during the recovery. For the average investor, trying to time the market rather than holding onto an appropriate portfolio would likely have done more harm than good.

Ultimately, much of investing depends not just on facts and figures but also on our own behavior. While it’s clear that there are manias, booms/busts, and expansions/contractions in the economy and markets, it is difficult to know how any particular situation will play out. What makes this more difficult is that downturns tend to occur swiftly, often with little notice, while rebounds occur slowly and steadily. This means that market pullbacks can drive a greater emotional response even if history shows they occur regularly.

Thus, this challenging market environment is an ideal time to remind ourselves to stay invested, diversified, and disciplined. Below are three charts that highlight the fact that boom/bust cycles and market volatility are a normal part of investing.

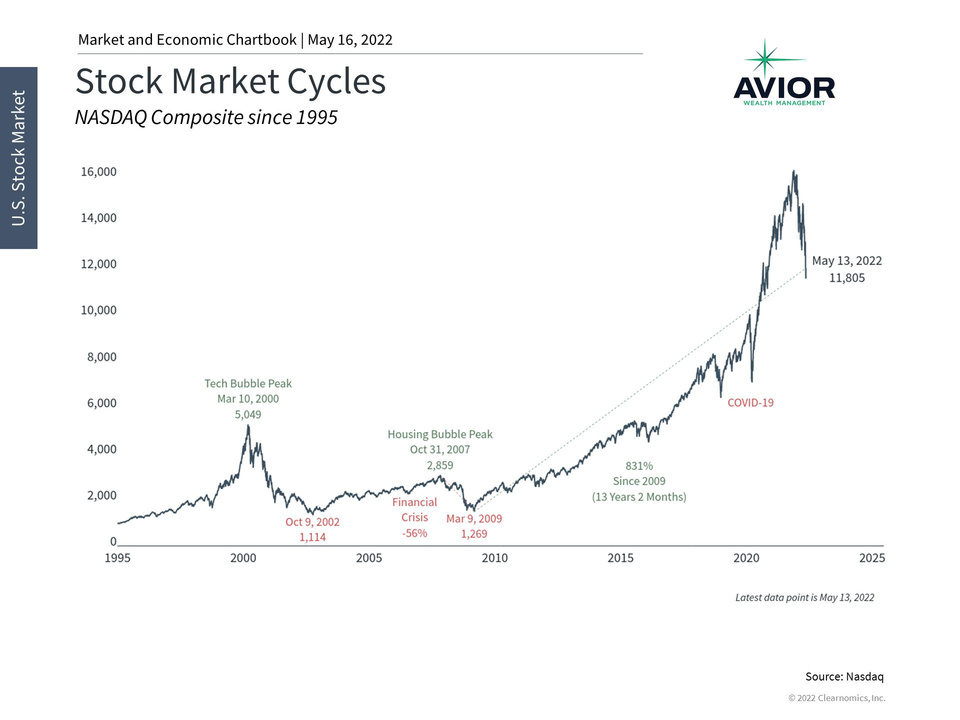

1. The Nasdaq has fallen into bear market territory

Stock Market Cycles

The Nasdaq is in bear market territory compared to its recent all-time highs. While this is challenging for many investors, it caps off a spectacular run that accelerated during the pandemic. Staying invested across sectors, not trying to pick individual winners, and staying invested are still the best ways to manage this market environment.

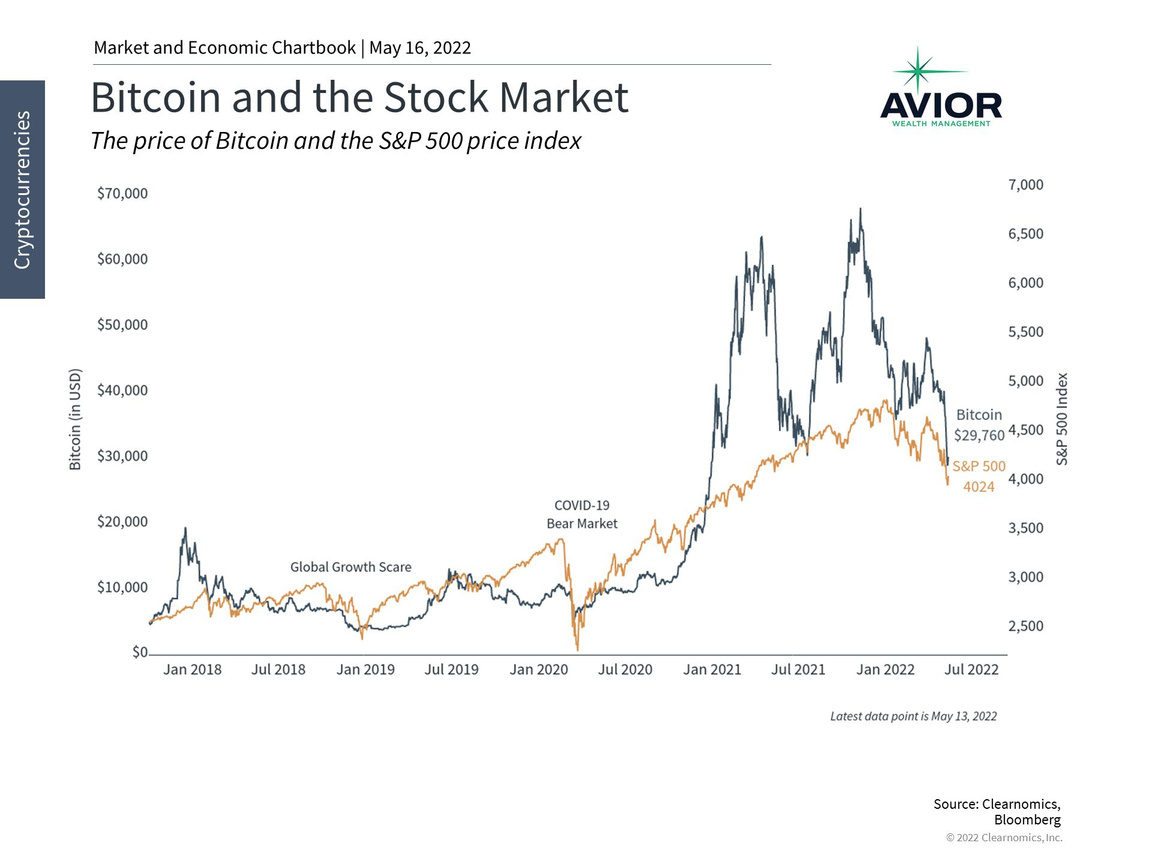

2. Bitcoin and the S&P 500 have generated similar returns

For investors, risk-adjusted returns are often more important than absolute returns. Bitcoin, for instance, garnered significant attention by rising in spectacular fashion over the past few years. However, with recent problems around rising rates and issues such as stablecoins, Bitcoin and the S&P 500 have generated similar returns over the past several years.

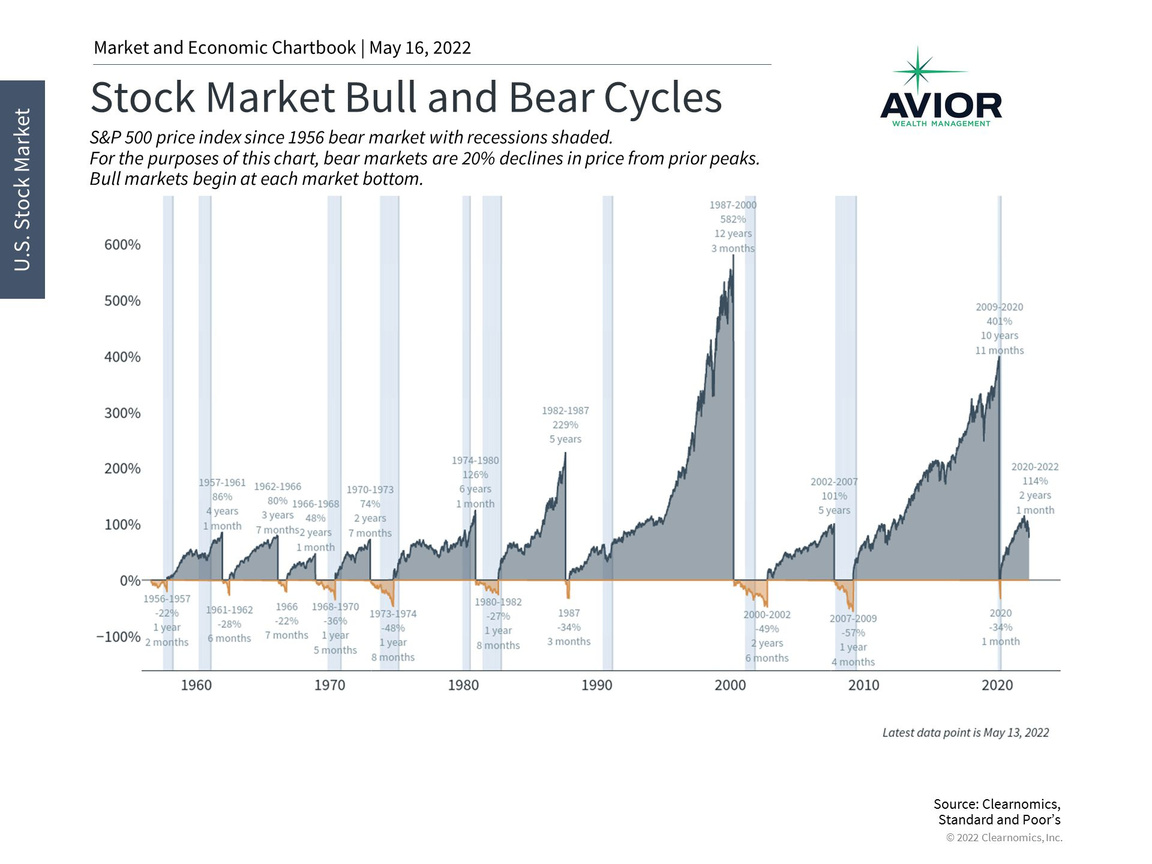

3. Investors should focus on long cycles and not short-term swings

Stock Market Bull and Bear Cycles

The stock market operates in cycles. Not only is this normal, but investors should not overreact to short-term pullbacks that occur within a cycle. Instead, the gains that are made in bull markets are what allow investors to gain true financial independence – if they have a well-constructed portfolio and stay the course.

The bottom line? Market cycles and intervening market volatility are a normal part of investing.

Disclosure: This report was obtained from Clearnomics, an unaffiliated third-party. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.avior.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments.

Avior Wealth Management, LLC, 14301 FNB Pkwy, Suite 110, Omaha, Nebraska 68154, United States, 402-218-4064

No Comments

Sorry, the comment form is closed at this time.