5 Insights to Understand Markets in 2024

2023 marked an inflection point for markets with strong gains across both stocks and bonds. The S&P 500, Dow, and Nasdaq generated exceptional returns of 26.3%, 16.2%, and 44.7% with reinvested dividends last year, respectively. The S&P has come full circle and is now only a fraction of a percentage point below the all-time high from exactly two years ago. The U.S. 10-Year Treasury yield climbed as high as 5% in October before falling to end the year around 3.9%, pushing bond prices higher in the process. International stocks also performed well with developed markets returning 18.9% and emerging markets 10.3%. What drove these results and how could they impact investors in 2024?

Perhaps the most important lesson of 2023 for everyday investors is that news headlines and economic events don’t always impact markets in obvious ways. Last year’s positive returns occurred despite historic challenges including the worst banking crisis since 2008, rapid Fed rate hikes, debt ceilings and budget battles in Washington, the ongoing war in Ukraine, the conflict in the Middle East, cracks in China’s economy, and many more. If you had shared these headlines with an investor at the start of 2023, they would probably have assumed there would be a worsening bear market or a deep recession.

Why isn’t this what happened? At the risk of oversimplifying, the key factor driving markets the past few years has been inflation. High inflation affects all parts of the markets and economy including forcing the Fed to raise interest rates, slowing growth, hurting corporate profits, dampening consumer spending, and acting as a drag on bond returns. This is exactly what occurred in 2022 but many of these effects reversed in 2023 as inflation rates improved.

The headline Consumer Price Index, for instance, jumped 9.1% in June 2022 on a year-over-year basis but only grew 3.1% this past November. Unfortunately for consumers and retirees, this does not mean that prices will fall back to pre-pandemic levels – only that they will rise more slowly. For markets, however, what matters is that the rate of change is slowing and that core inflation could gradually approach the Fed’s 2% long run target.

Thus, the recession that was anticipated by markets a year ago has not yet occurred. While many still expect economic growth to slow this year, it’s not unreasonable to suggest that the Fed could achieve a “soft landing” in which inflation stabilizes without causing a recession. This is why both markets and Fed forecasts show that they could begin to cut policy rates by the middle of the year.

What does this mean for the year ahead? If 2022 was characterized by the worst inflation shock in 40 years, leading to a bear market in stocks and bonds, 2023 saw many of these factors turn around. These trends could continue if the Fed does begin to ease monetary policy. Of course, much is still uncertain and investors should always expect the unexpected when it comes to market, economic, and geopolitical events. After all, markets never move up in a straight line and even the best years experience several short-term pullbacks.

The past year has shown us that it’s important to stay invested and diversified across all phases of the market cycle, rather than try to predict exactly what might happen on a daily, weekly, or monthly basis. Below are five key insights into the current market environment that will likely be important in 2024.

1. Many asset classes performed exceptionally well in 2023

Strong economic growth and falling rates propelled many asset classes higher last year. Stocks reversed much of their losses from the previous year with a historically strong gain and bonds bounced back as interest rates fell in the final months of the year. Technology stocks, especially those related to artificial intelligence, helped to drive market returns as well, pushing the Nasdaq to a nearly 45% return. While the so-called “Magnificent 7” did double in value, other sectors also began to perform better as market conditions improved.

Most importantly, there are signs that earnings growth is recovering. Earnings-per-share for the S&P 500 are expected to have been flat in 2023, but Wall Street consensus estimates suggest that they could grow by double digits each of the next two years. While this will depend on the path of economic growth, any increase in earnings will help to improve valuations and support the stock market.

2. Bonds have rebounded as interest rates have stabilized

Bonds had a much better year with interest rates rising through October then falling on positive inflation data. While bonds have not recovered their 2022 losses after a historic spike in inflation, recent performance shows that bonds are still an important asset class that can help to balance stocks in diversified portfolios. This is true across many sectors including high yield, investment grade, government bonds, and more.

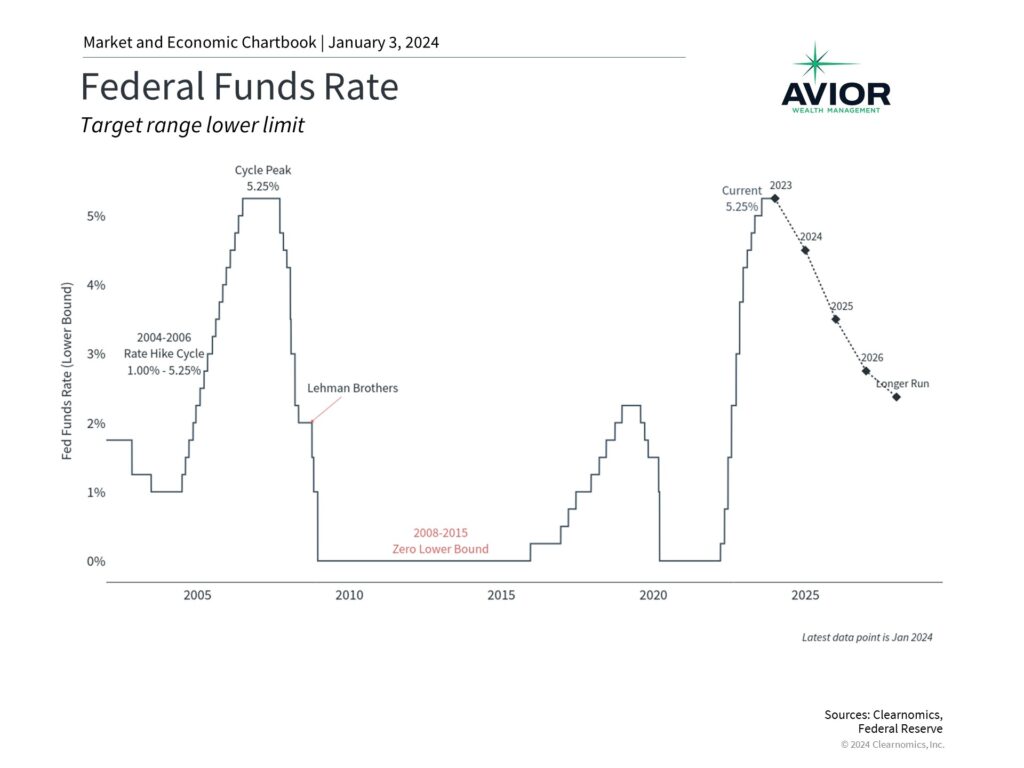

3. The Fed is expected to cut rates in 2024

Improving inflation coupled with a historically strong job market have helped the Fed to achieve its policy objectives. While it’s too early to declare victory, many expect the Fed to begin cutting rates in 2024. The Fed’s own projections suggest they could lower rates by 75 basis points by the end of the year. Market-based expectations are much more aggressive and are expecting twice as many cuts. While it’s hard to predict exactly what the Fed may do this year, the fact that rates could begin to fall could help to support financial markets and the economy.

4. The economy has been remarkably strong

The economy has been stronger than many expected over the past twelve months. GDP grew by 4.9% in the third quarter, one of the fastest rates in recent years. Consumer spending helped as did a rebound in business investment as the interest rate outlook stabilized. Unemployment is still only 3.7% and while monthly job gains have slowed somewhat, the labor market is still far stronger than economic theory would have predicted given the sharp increase in interest rates.

5. The most important lesson for investors is to stay invested

While the past twelve months have been positive for investment portfolios, investors should not become complacent. Volatility in the stock market is both normal and expected with even the best years experiencing short-term swings, as shown in the accompanying chart. Rather than trying to predict exactly when these pullbacks will occur, it’s more important for investors to hold diversified portfolios that can withstand unforeseen events. The past few years are a reminder that holding an appropriate portfolio is the best way for investors to achieve their long-term financial goals.

No Comments

Sorry, the comment form is closed at this time.