Why Bonds Are Increasingly Attractive for Long-Term Investors

The bond market has had a better year in 2023 despite ongoing swings in interest rates. The U.S. Aggregate bond index has rebounded 2.7% year-to-date after briefly hovering in the red a few months ago. This is because inflation continues to improve and many investors believe the Fed is not only done raising rates but may begin cutting next year. This is also in stark contrast to 2022 when the bond market fell 13% as interest rates rose swiftly. So, while the bond market is having a better but not exceptional year, the economic climate may be shifting in its favor. What should diversified investors consider as the interest rate story unfolds?

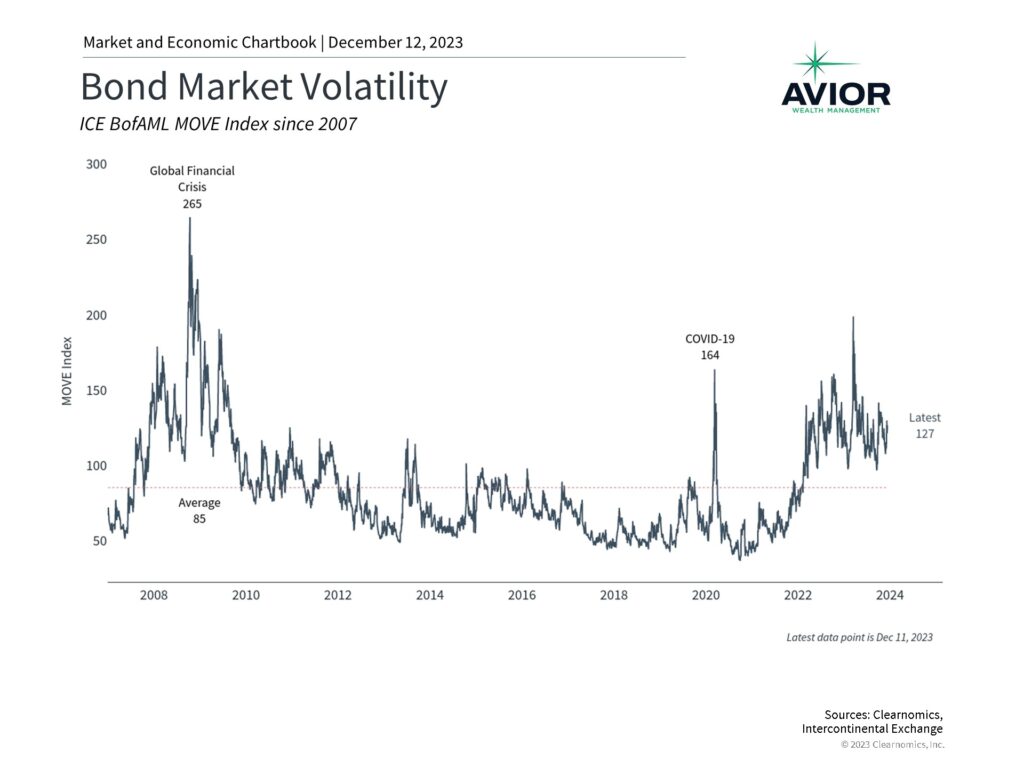

Bond market volatility has remained elevated this year due to the banking crisis and the rate jump that began in late summer. The 10-Year Treasury yield has risen from 3.9% at the start of the year to 4.2% today, briefly hitting 5% along the way. For perspective, the 10-Year yield was only 1.5% at the beginning of 2022 and fell as low as 0.5% in 2020. Both the level and change in rates impact the prices and returns of the bond market, affecting portfolio returns.

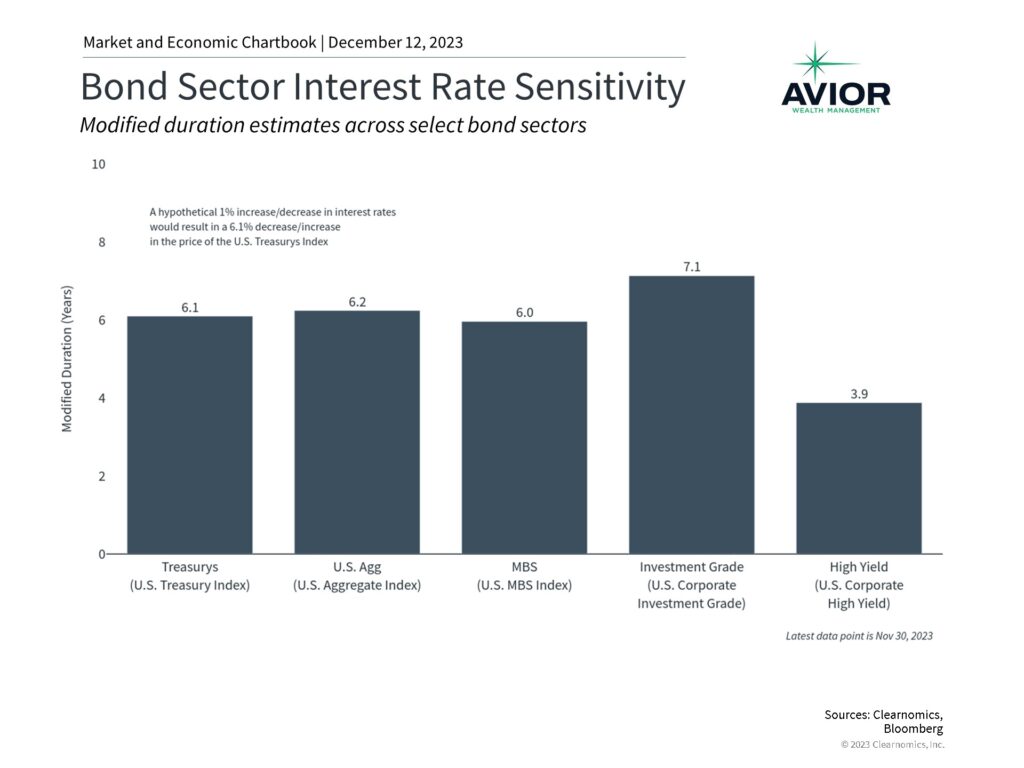

Bonds are highly sensitive to interest rate fluctuations

These dynamics have called into question the traditional role of bonds as portfolio stabilizers and consistent sources of yield and returns. Ideally, bonds rise when stocks fall, leading to more balanced portfolios. This was generally the case from the mid-1980s until recently as steadily declining interest rates led to higher bond prices over 40 years. While the past few years have led some investors to question whether this pattern will resume, it’s important to examine why bonds behave this way in the first place.

One way to understand why bond prices tend to fall when interest rates rise is that investors can now buy bonds with higher yields, reducing the value of previously issued bonds. The reverse is also true – when interest rates fall, bond prices tend to rise, all else equal. On a more technical basis, rising rates mean that the present values of future bond payments are worth less than before. This is true when interest rates rise for any reason but can be especially challenging when this is due to inflation.

To measure the effect that changing interest rates have on bond prices, investors often use a concept known as “duration” (in this discussion we’ll focus on “modified duration”). In its simplest form, duration tells us how much the price of a bond (or bond index) would gain or lose if interest rates were to fall or rise by one percentage point. For example, the accompanying chart shows that the U.S. Treasury Index has a duration of 6.1 years, implying that a 1% rise in interest rates would result in a 6.1% decrease in the price of the bond index, and vice versa.

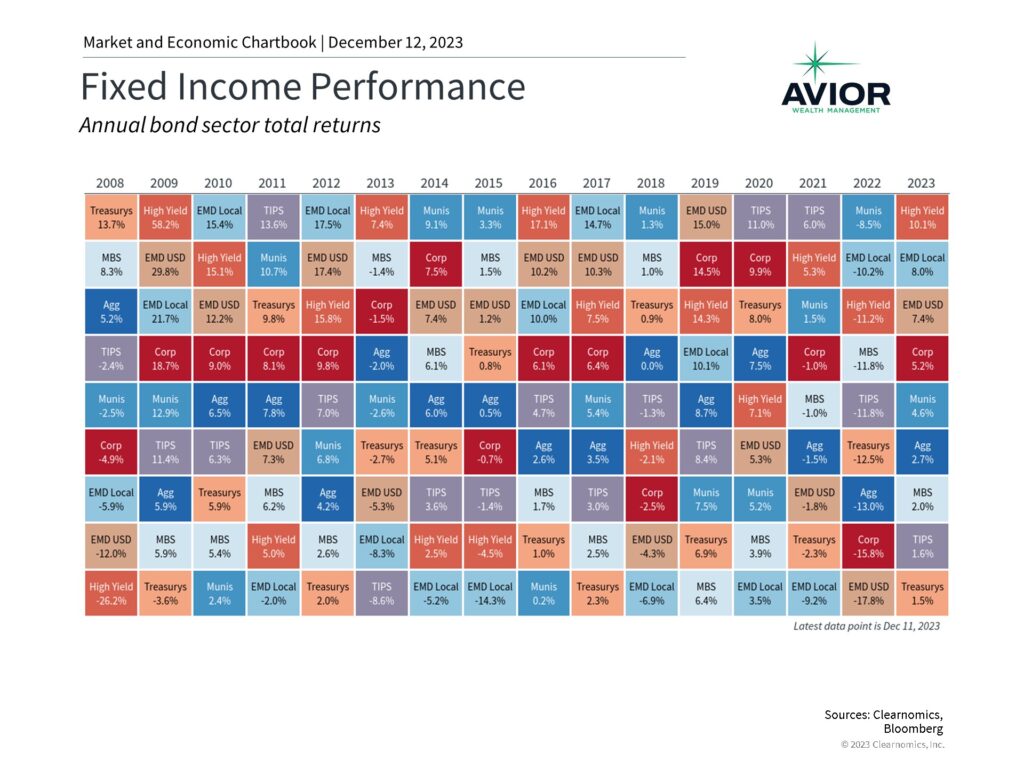

Many bond sectors have rebounded in 2023

These calculations are only estimates and make strong assumptions, such as that interest rates rise equally across maturities (which they never do), there is no impact from embedded call options (which is incorrect for certain bonds), and more. Despite being only an approximation, duration is a valuable concept that can help investors understand how bonds perform. For example, the 10-Year Treasury yield rose 2.4% in 2022 which would predict about a 14% decline in Treasury prices – not far off from the realized 13% figure.

Duration varies across bond sectors depending on their characteristics. High yield bonds, for instance, tend to be highly correlated with stocks and have shorter maturities so are less sensitive to interest rates alone. They are among the best performing parts of the market this year as risky assets have surged. High quality corporate bonds, on the other hand, tend to be more sensitive to interest rates since investors buy them for their coupon payments. These bonds have gained 5.2% this year on average as interest rates have stabilized and the economy has grown steadily.

Bond market volatility has been elevated

So, while the jump in interest rates over the past two years has raised questions for some asset allocation strategies, the bond market reaction is easy to understand. These concepts suggest that more stable rates would be a welcome sign for investors and could help to reestablish bonds as portfolio stabilizers. Since duration calculations go in both directions, bond prices could benefit if rates were then to decline. The possibility that the Fed could cut rates next year has already supported bond prices and could continue to do so if long-term interest rates begin to ease as well.

The bottom line? While bonds have struggled as interest rates have risen, there are signs that rates could stabilize in the year ahead. Long-term investors should remain diversified across stocks and bonds as they work toward their financial goals.

Disclosure: This report was obtained from Clearnomics, an unaffiliated third-party. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.aviorwealth.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. Please remember to contact Avior, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, or modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian. A copy of our current written disclosure Brochure and Form CRS (Customer Relationship Summary) discussing our advisory services and fees continues to remain available upon request or at www.avior.com.

No Comments

Sorry, the comment form is closed at this time.