How the Budget Battle in Washington Impacts Investors

The battle over the federal budget in Washington is adding to political uncertainty at a time when investors are already nervous about the economy and financial markets. Lawmakers are running out of time to agree on and approve a new budget after kicking the can down the road twice since last September. The fact that this is a presidential election year and GOP caucuses are underway only adds to the concerns investors may have over the impact of politics on their portfolios. How can investors maintain perspective during this important political year?

It’s no secret that political differences between and within the major parties have grown in recent years. This is why, when it comes to financial planning and investing, it’s always important to separate political views from portfolio decisions. As citizens, voters and taxpayers, expressing political preferences via the ballot box, campaigning and community organizing is an important part of our democracy. However, while Washington politics do affect our personal lives and legislation can impact specific industries, they don’t always impact the stock market the way we might expect.

The federal debt is a central issue for Congress and voters

The current budget battle is just the latest in a long line of issues in Washington. While the situation is still evolving, at the time of this writing Congressional leaders had agreed on an outline for a new $1.66 trillion budget but not the details. In order to avoid a government shutdown, either a full budget must be passed before the upcoming January 19 deadline or a “continuing resolution” is needed to extend the deadline. Congress has already passed two continuing resolutions since last September.

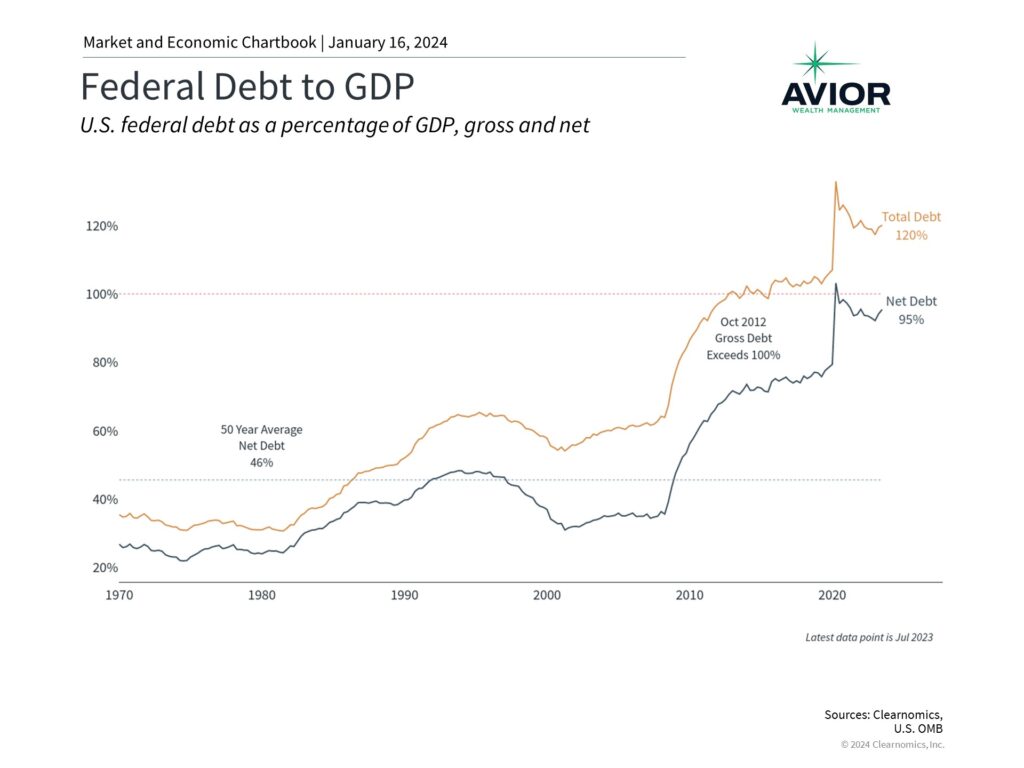

Why has it been so difficult for policymakers to agree on a new budget? Every year since 2001, the federal government has operated at a deficit and the federal debt has grown. Today, the federal debt stands at $33 trillion, more than 10 times its 2000 levels, representing 120% of the country’s gross domestic product. Even when adjusting for what the government owes itself, also known as “net debt,” this number has risen to 95% of GDP. As the accompanying chart shows, the debt has ballooned during periods of economic crisis when the government spends to stimulate the economy, such as during the 2008 financial crisis and the recent pandemic.

Government borrowing to fund deficits has increased

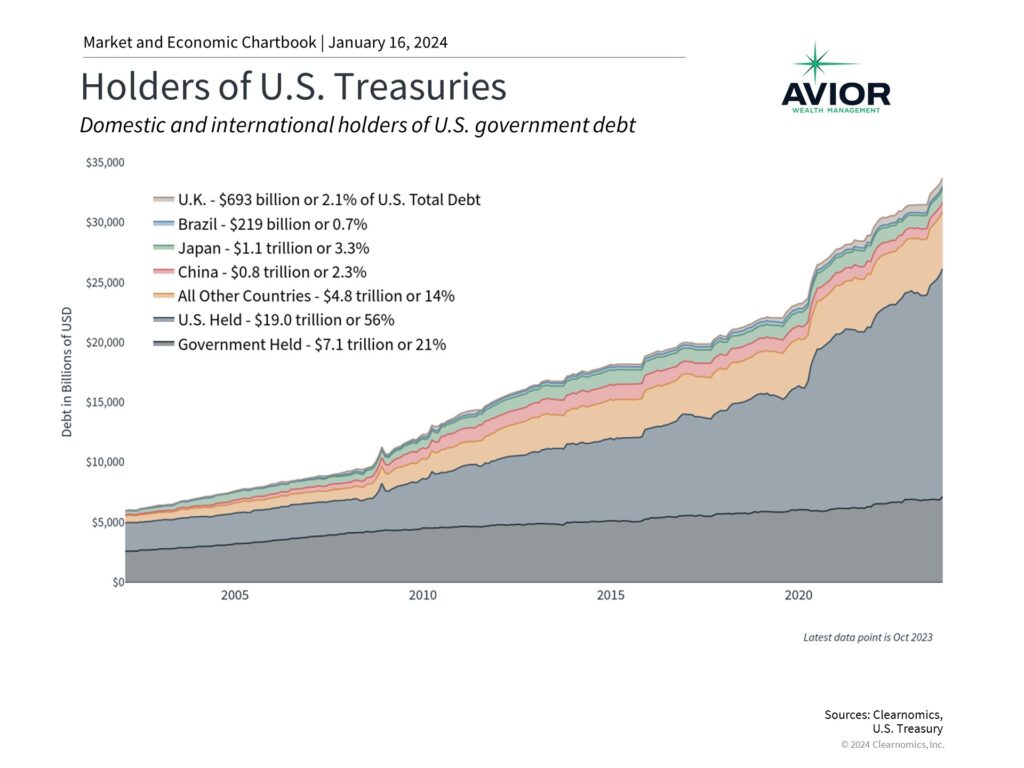

One important distinction is that the current budget situation is different from the debt ceiling debate. Since the government operates with a budget deficit, meaning it spends hundreds of billions more than it collects in revenues, the Treasury department needs to borrow funds to pay government bills. The limit on this borrowing needs to be extended periodically and has resulted in heated political battles over the past decade. The accompanying chart shows that the issuance of Treasury securities has grown over time and that many domestic and foreign parties, which consist of investors, corporations, and other governments, hold these securities. Unfortunately, the next debt ceiling debate will occur in less than a year at the start of 2025, soon after the presidential election.

While the consequence of not passing a budget is a government shutdown, not raising the debt limit risks a government default on Treasury securities. Combined, these are central reasons that bond ratings agencies have downgraded or threatened to downgrade the U.S. debt. Standard & Poor’s did so in 2011, leading to a market pullback, while Fitch downgraded the U.S. debt from AAA to AA+ last August. Moody’s, the last of the three large credit ratings agencies, has not downgraded the U.S. debt but lowered the outlook to negative last November.

Tax rates are low by historical standards

Fortunately for everyday individuals, Congress has reached an agreement on a new tax package that includes important items such as the child tax credit and tax breaks for businesses. While the $78 billion package is not a done deal just yet, the fact that it received bipartisan support is a positive sign.

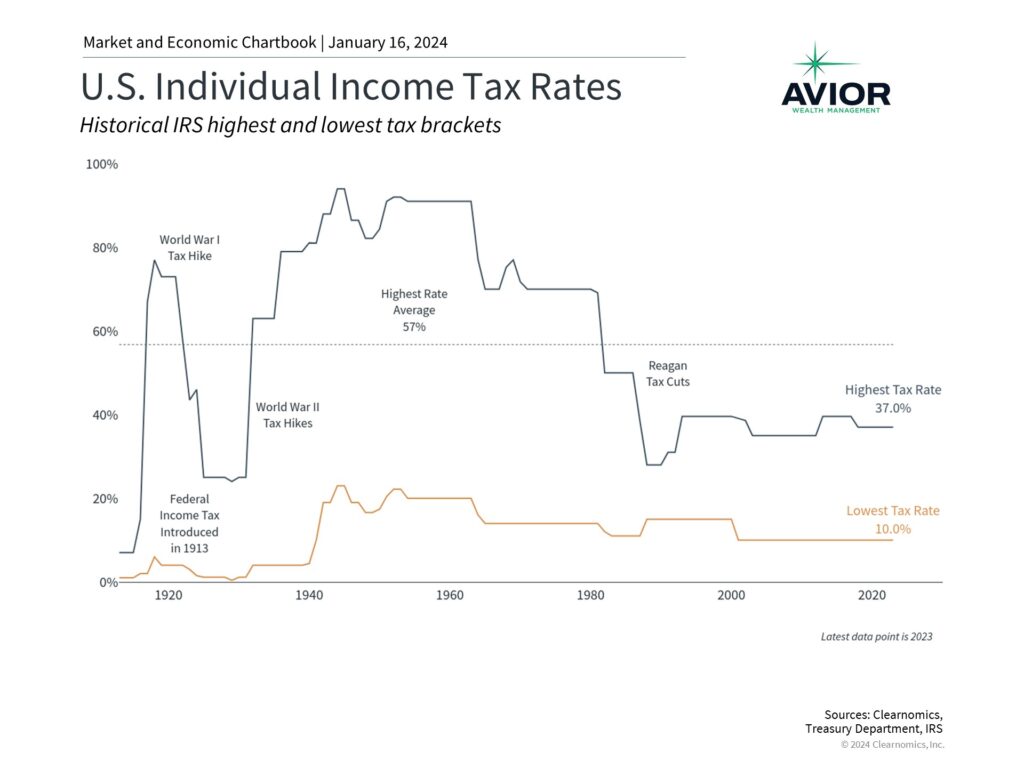

Taxes are always top-of-mind for households because persistent budget deficits and the level of the national debt can only be improved either with reduced spending or increased revenues. The last balanced budgets occurred during the Clinton and Nixon administrations, at the turn of the century and in the early 1970s, respectively. Thus, many worry that taxes could increase in the coming years. As shown in the accompanying chart, the highest tax rates, which reached 94% in the mid-20th century, have been much lower since the Reagan tax cuts. The complex and ever-changing tax landscape is one reason all investors can benefit from the advice of a trusted financial advisor.

With concerns over a new federal budget, the debt ceiling, tax policy, and the presidential election, how can investors maintain perspective as political events unfold? The reality is that the stock market has performed well despite political and fiscal challenges in Washington. This has been the case during election years, when different political parties are in power, and even during fiscal crises. With the benefit of hindsight, making portfolio decisions in response to news on these issues would have caused investors to miss the entire bull market beginning in 2009, the strong rally following the pandemic, last year’s market rebound, and more.

The bottom line? Investors should focus on staying invested and diversified rather than reacting to day-to-day Washington headlines. Sticking to a financial plan that is designed around long-term goals and tax considerations is still the best way to achieve financial success.

Disclosure: This report was obtained from Clearnomics, an unaffiliated third-party. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.aviorwealth.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. Please remember to contact Avior, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, or modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian. A copy of our current written disclosure Brochure and Form CRS (Customer Relationship Summary) discussing our advisory services and fees continues to remain available upon request or at www.avior.com.

No Comments

Sorry, the comment form is closed at this time.