Tax Implications of Your Retirement Contributions

Whether you contribute to an employer-sponsored plan or an IRA, factor in these tax benefits and implications to optimize tax planning

It’s not always easy to understand how your retirement account contributions are impacting your taxes. Even though many retirement savings avenues provide tax advantages, there are still key considerations to factor into planning to maximize results and minimize your tax liability.

For instance, IRAs, 401(k)s, pensions, and Social Security benefits will all have different tax implications, in addition to any income you receive from alternative revenue streams, like real estate or investments.

Find out how to factor your IRA and 401(k) retirement contributions into your tax plan.

Tax benefits of 401(k) contributions

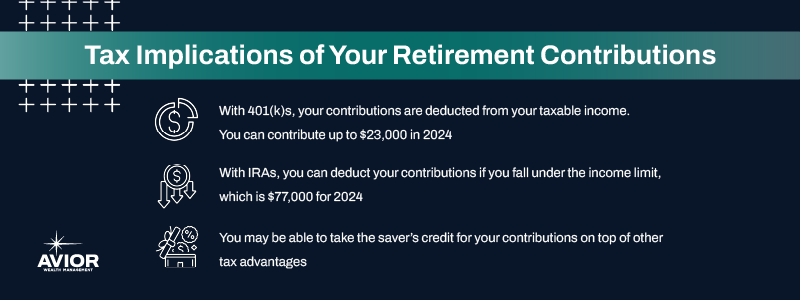

Employer-sponsored plans are typically 401(k)s or 403(b)s. These accounts have tax advantages, primarily that you defer paying taxes on your contributions now. Contributions are taken out of your paycheck before tax. However, in retirement, you will have to pay taxes on your withdrawals.

Your 401(k) contributions are tax-deductible. This means that when you get your W-2 tax form in January for the previous year, your taxable earnings will exclude what you contributed to your retirement account. So, you don’t need to actually claim this deduction when filing your tax return since contributions are not included in your taxable income.

For 2024, contribution limits are $23,000 for your contributions and $69,000 for combined employee and employer contributions.

Contributing to traditional and Roth IRAs

IRAs, or individual retirement accounts, provide many of the same benefits as 401(k)s, including pre-tax contributions and tax-deferred growth. You’ll have to pay income tax on your withdrawals in retirement with traditional IRAs. Roth IRAs, on the other hand, allow you to pay taxes on your contributions now, and in retirement, you don’t pay income tax on withdrawals.

You may be able to deduct IRA contributions as well. This is true only for traditional IRA contributions.

However, if you also have a retirement plan from your employer, deductions depend on certain income limits. If your income is under $77,000, or under $123,000 for joint filers, you can claim a tax deduction for traditional IRA contributions.

Even though you don’t get an immediate tax deduction, many people choose Roth IRAs to get the tax benefits in retirement. This is especially helpful if you estimate that your income will be higher in retirement than it is now, since you want to be in the lowest tax bracket possible when paying taxes.

Then there are the contribution limits to consider. If your income is under $146,000, or $230,000 for joint filers, the maximum contribution you can make to both traditional and Roth IRAs is $7,000 in 2024. From there, as income levels increase, the maximum contribution limits decrease. Note that you must make less than $161,000 in 2024 to contribute to a Roth IRA.

Paying attention to these limits is important. You could face a 6% penalty from the IRS if you contribute more than these caps each tax year.

Catch-up contributions for taxpayers over 50

For both IRAs and 401(k)s, older contributors can make something called catch-up contributions. For IRAs, you get an extra $1,000 in contributions, and for 401(k)s, you can contribute an extra $7,500 if you’re 50 or older. These additions are in place since, the closer you get to retirement, the more you want to start saving to maximize your income.

These contributions are treated like your other contributions when it comes to taxes, so it depends on your type of retirement account. Just remember to factor in any catch-up contributions with your tax plan.

What about the saver’s credit?

The retirement savings contributions credit (also known as the saver’s credit) is another tax break many Americans qualify for. However, it’s geared toward low- to mid-income taxpayers, so you may not be eligible unless you have a lower-income tax year. This credit applies to contributions to many different types of retirement savings vehicles.

This credit is equal to 50%, 20%, or 10% of your contributions, depending on your income. For 2024:

- Single filers with an income of $23,000 or less get a 50% credit ($46,000 or less for joint filers).

- Those with $23,001 to $25,000 get a 20% credit.

- Those with $25,001 to $38,250 get a 10% credit.

If your income is above $38,250, you don’t qualify (or $76,500 for joint filers or $57,375 for heads of household).

You can save any amount in an eligible retirement account to qualify for this credit. However, you can only count $2,000 in contributions for single filers and $4,000 for joint filers.

Eligible taxpayers are those who are:

- 18 years of age or older

- Not claimed as a dependent on another tax return

- Not a student

Qualifying retirement accounts are IRAs, 401(k)s, 403(b)s, 457(b)s, SARSEP and SIMPLE plans, ABLE accounts, 501(c)(18)(D) plans, and Thrift Savings Plans.

Maximize your retirement contributions with tax planning

Learning the pros and cons of each retirement account will help you effectively plan for taxes, now and in the future. Closely follow any contribution limits to avoid tax penalties, keep adequate records of your contributions, and plan for additional tax credits and catch-up contributions.

One of the best steps you can take right now is to talk to a financial professional about your retirement plans. An advisor at Avior can assist with effective investment strategies to help you and your family meet your long-term savings goals.

Contact Avior to get started with expert guidance today.

Disclaimer: Nothing contained herein should be construed as legal or tax advice. Avior and our Advisors will work with your attorney and/or tax professional to assist with your legal and tax strategies. Please consult your attorney or tax professional with specific legal and/or tax questions. Investment Management and Financial Planner are offered through Avior Wealth Management, LLC, an SEC-registered investment advisor. Past performance is not a guarantee of future results. Investments are subject to loss, including the loss of principal.

No Comments

Sorry, the comment form is closed at this time.