AVIOR INSIGHTS – 7 Insights for Inflationary Markets in Q4 and Beyond

In times like these, investors would naturally prefer to wait until it feels comfortable to invest, and even experienced investors may wonder if markets will ever turn around. This is why it’s important to remind ourselves that while bear markets are unpleasant, they also create opportunities for long-term investors. The valuations of major indices, sectors and styles are at their most attractive levels in years, and bond yields are finally at levels that can support portfolio income.

A key principle of investing is that achieving long-term returns doesn’t just involve risk – it requires it. This is true whether markets are down due to the economy, geopolitics, a pandemic, or any of the hundreds of investor concerns over the past few decades. After all, if staying invested were easy, everyone would do it and there would be no opportunities at all. History shows that those investors who have the discipline and fortitude to handle market pullbacks are more often than not rewarded. So, for those focused on the rear-view mirror, the glass may seem half empty. For those focused on future recovery and growth, the glass is overflowing. Having the right mindset to overcome our own psychology has never mattered more.

At the same time, it’s also important to understand what is driving these market dynamics. Below, we highlight seven important insights that will continue to affect markets and the economy through the remainder of 2022 and beyond.

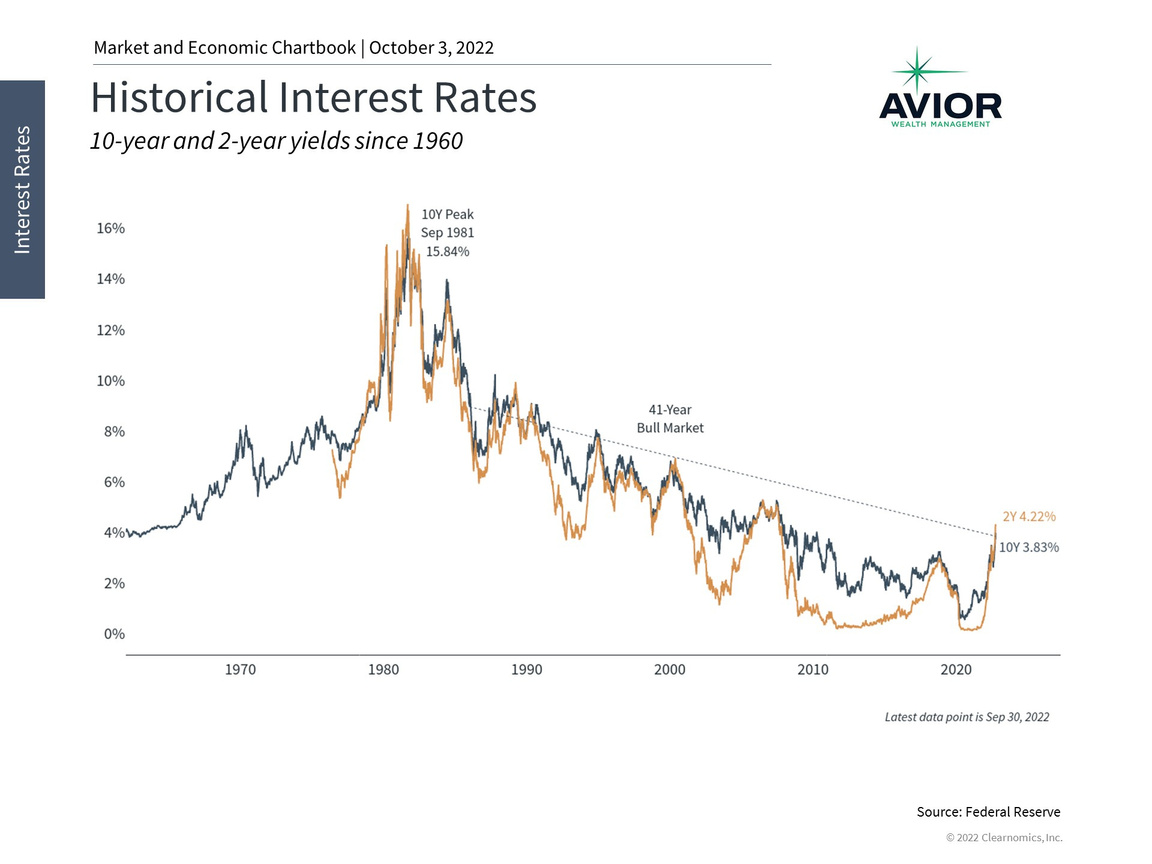

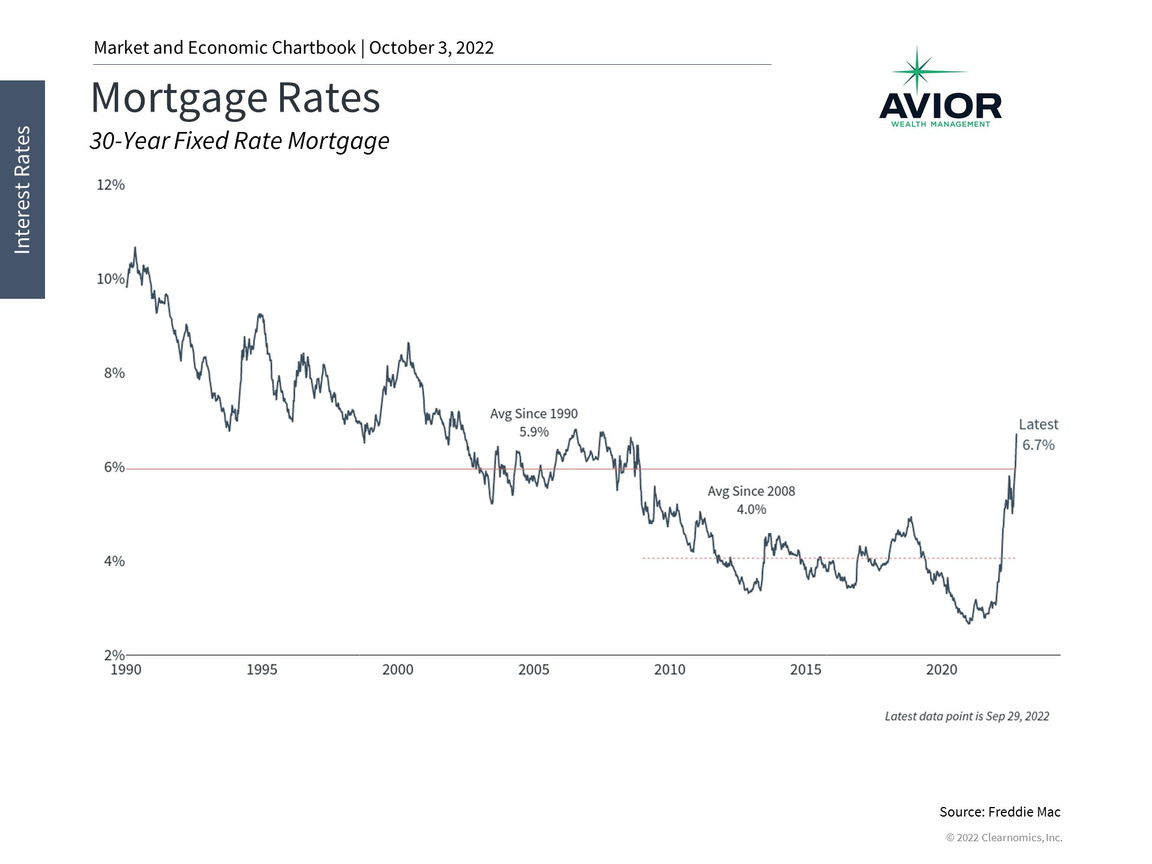

1. Interest rates are rising after declining for 40 years

This jump in both policy and market rates is breaking a 40-year pattern of declining interest rates. It’s no wonder that financial markets have been volatile as they adjust to a higher cost of capital and slower economic growth. Regardless, both history and the summer period show that markets can move forward once they digest these new expectations.

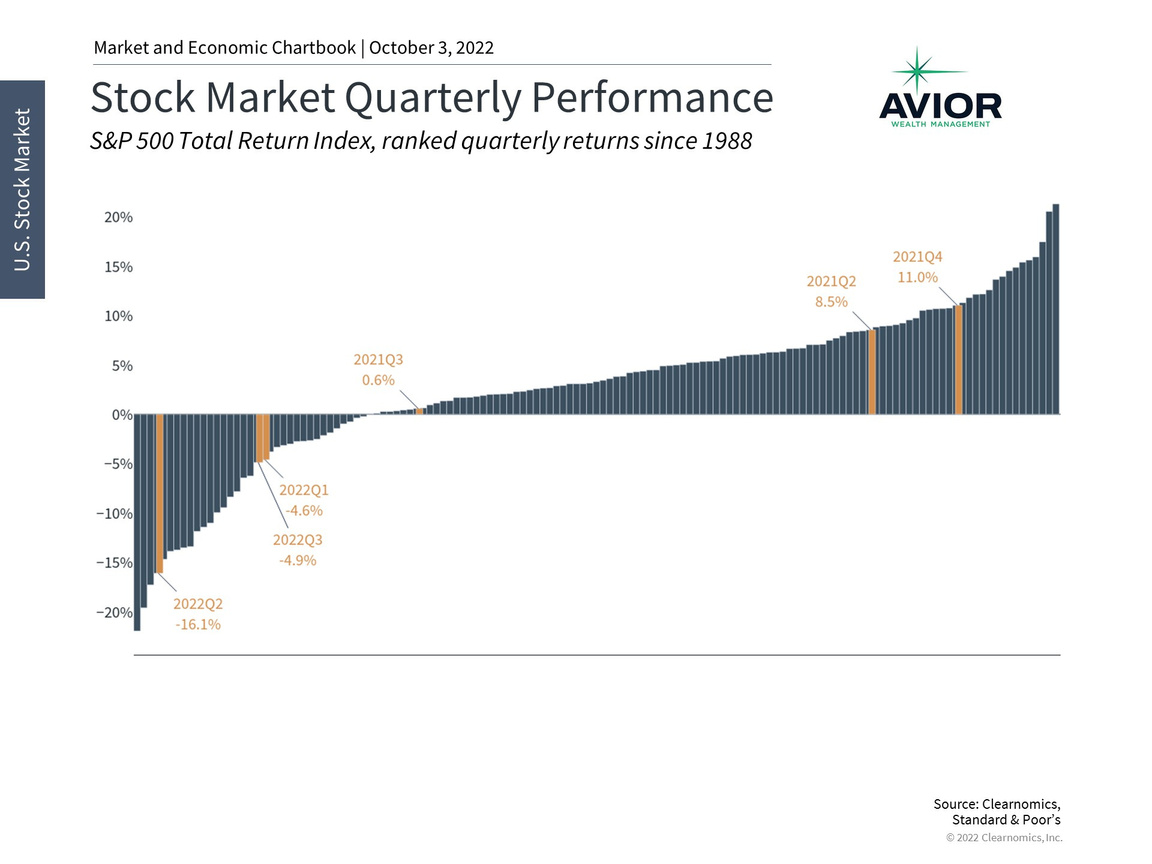

2. The stock market is adjusting to higher inflation and rising rates

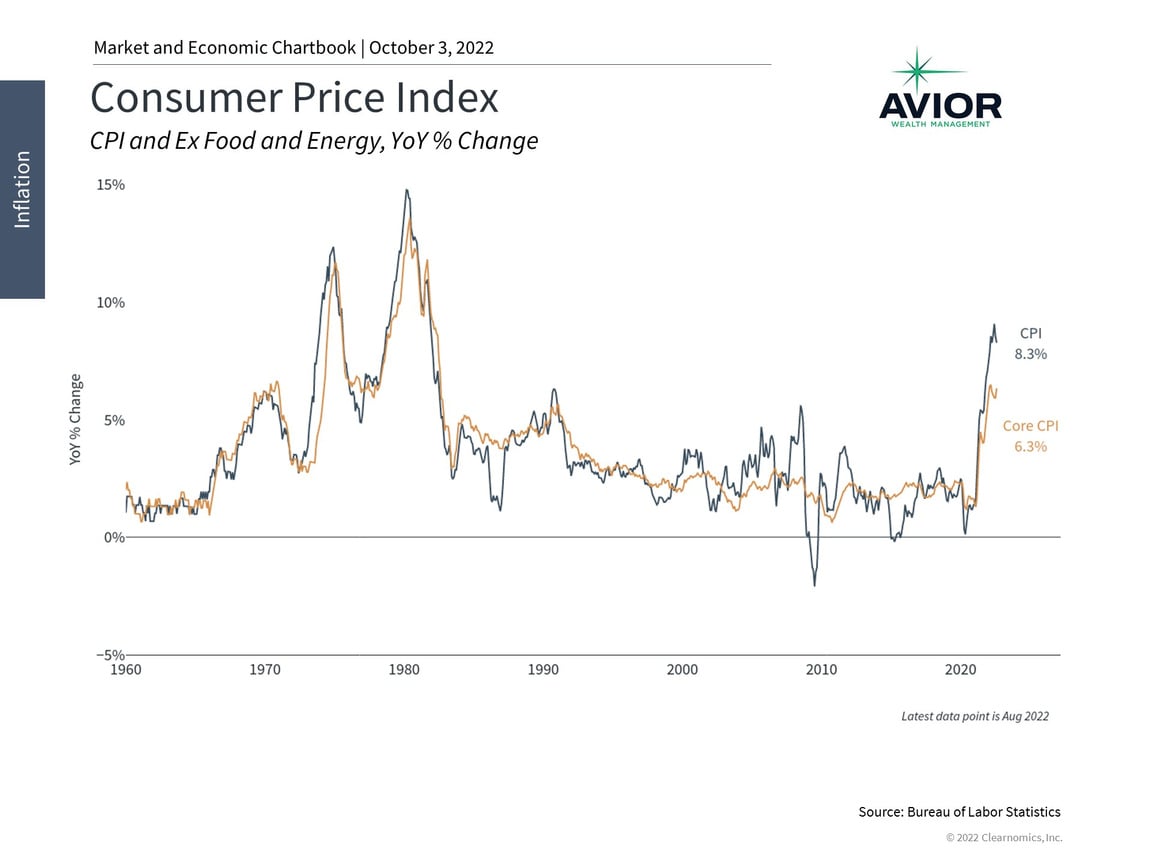

3. Inflation is still elevated despite falling energy prices

Economists and policymakers continue to focus on “core” inflation which re-accelerated in August, a sign that price pressures have broadened and continue to hurt consumer pocketbooks. This is a key reason the Fed has doubled down on its inflation fight.

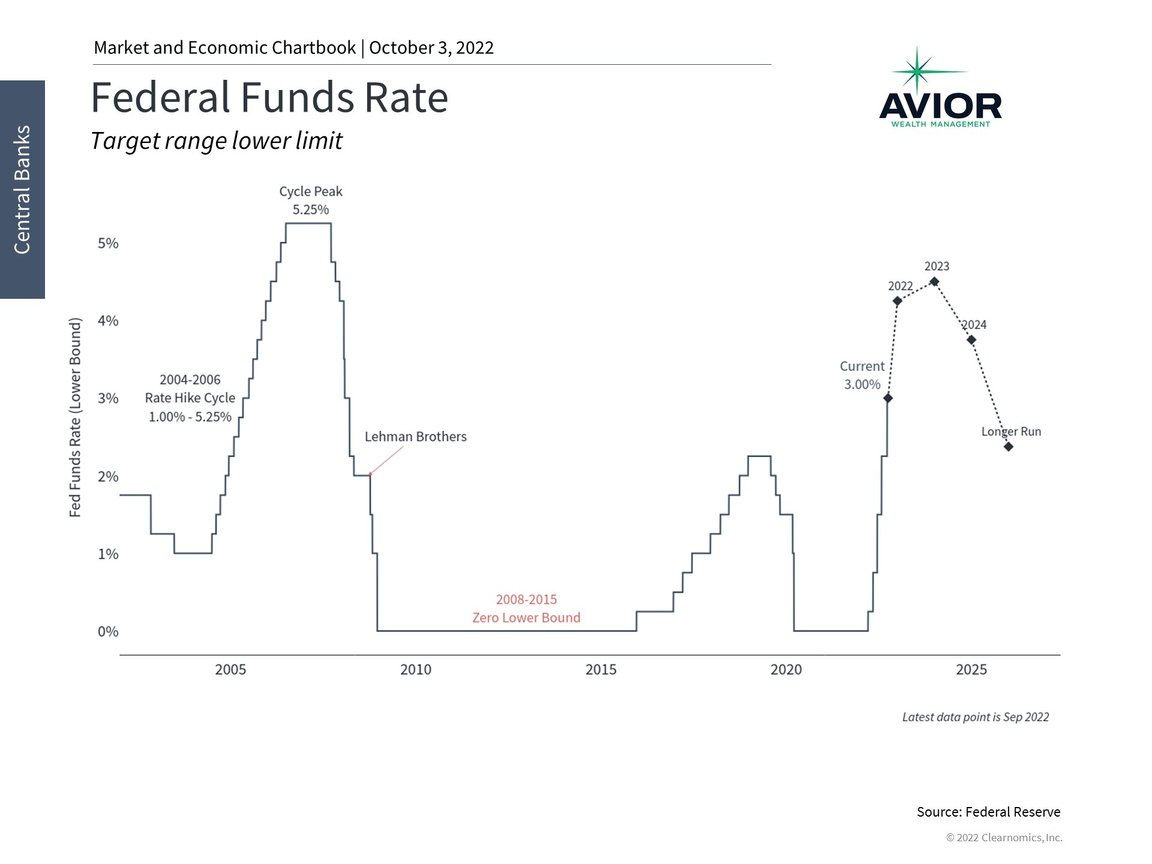

4. The Fed is expecting to keep rates higher for longer

5. Higher mortgage rates have slowed the housing market

While there may be some similarities, this underlying situation is quite unlike the housing bubble of the late 2000s. The key difference is financial leverage across individuals, banks, and throughout the financial system. The underlying fundamentals are much better today than those leading up to 2008. Still, a struggling housing market may impact consumer spending and retail sales as household net worth comes down, at least on paper.

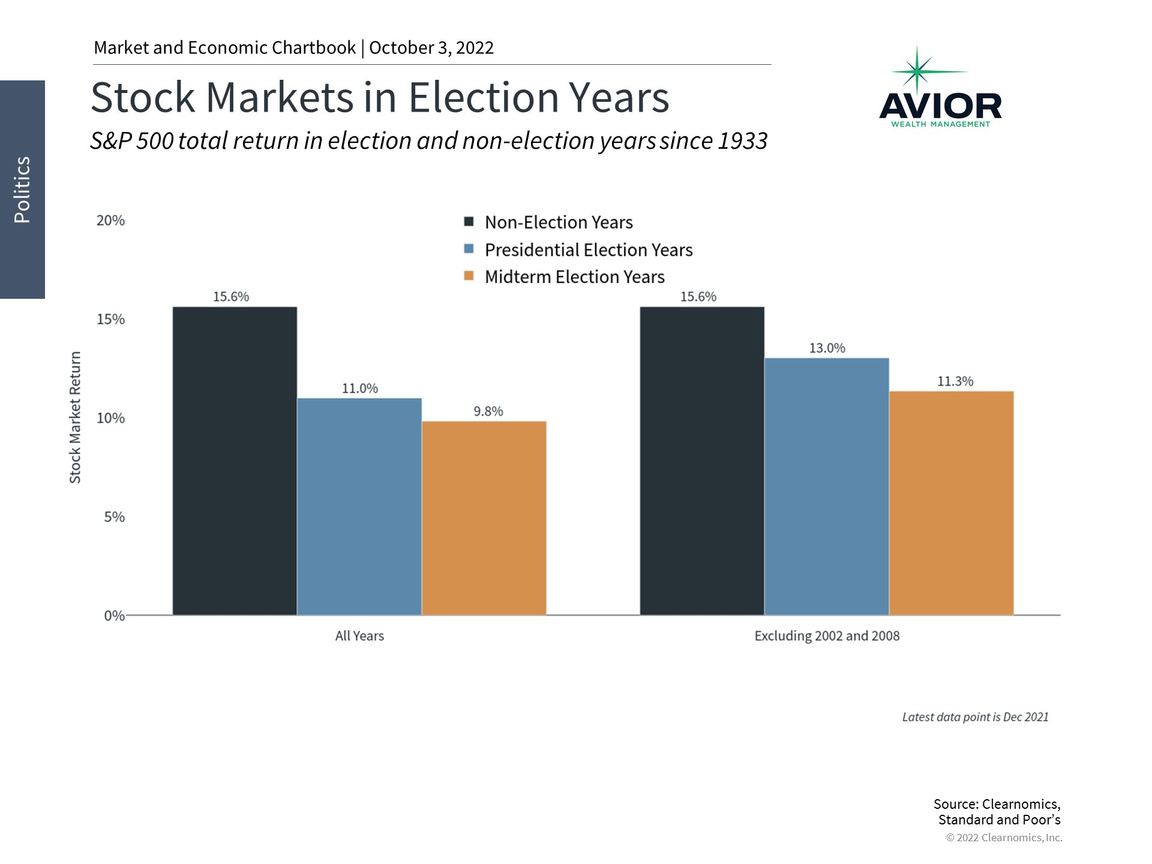

6. The midterm elections have not been a major driver of markets this year

The factors that have driven markets this year are mostly independent from the fact that it happens to be a midterm election year. Some investors worry about these years since they tend to have somewhat lower expected returns. However, going back to 1933, history shows that these returns are still extremely positive on average. Other factors such as the economy and where we happen to be in the market cycle have mattered much more.

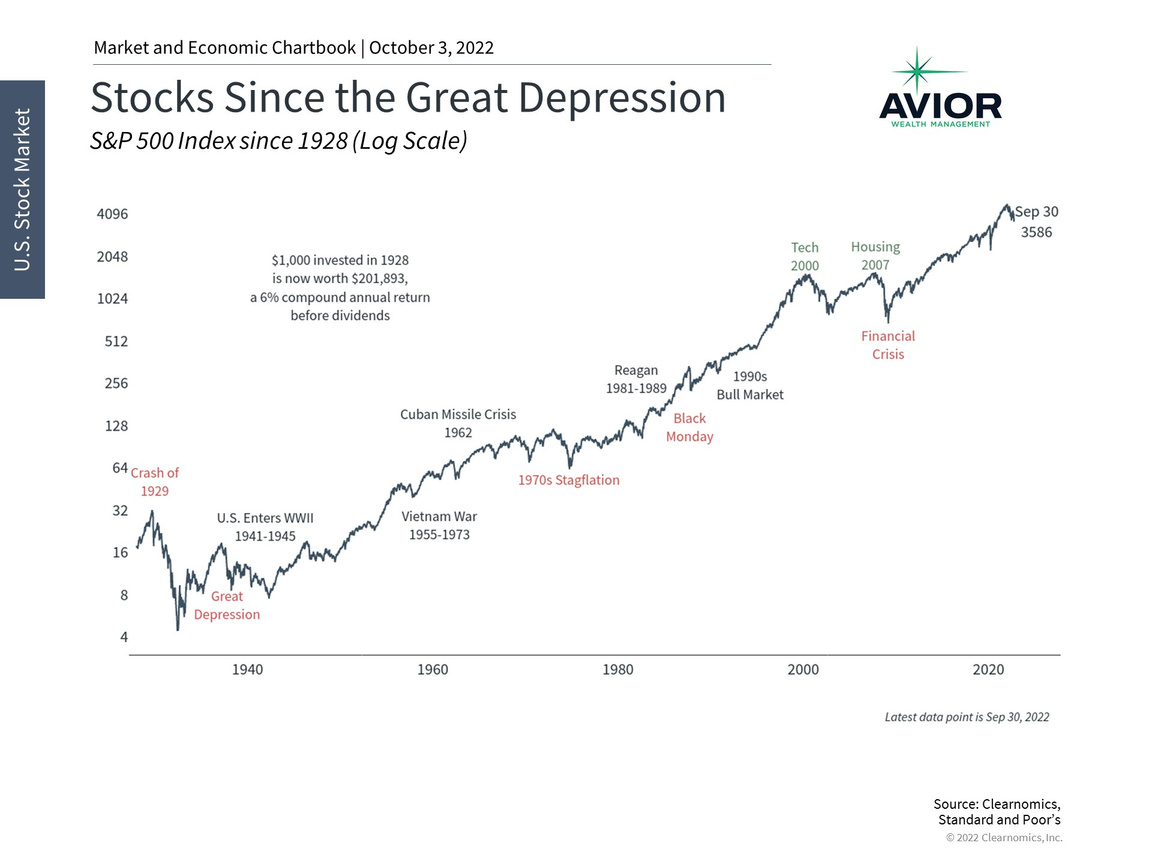

7. Investors should continue to focus on the long run

If history teaches us anything, it’s that fighting the urge to overreact to short-term events is one of the keys to long-term investor success. This chart shows the S&P 500 index going back to before the Great Depression. The fact that the market trends upward over time and follows the path of economic growth is clear. Along the way, there were countless major historical challenges to overcome from wars to bear markets. When zoomed out, these look like blips compared to the gains investors achieved over years and decades.

The bottom line? The ongoing bear market is challenging and unpleasant. However, it is no reason for investors to lose sight of their financial goals. In fact, those investors with the discipline and patience to take advantage of opportunities will likely be rewarded in the long run.

Avior Wealth Management, LLC, 14301 FNB Pkwy, Suite 110, Omaha, Nebraska 68154, United States, 402-810-7831

No Comments

Sorry, the comment form is closed at this time.