AVIOR INSIGHTS – How Investors Can Stay Positive Amid Market Uncertainty

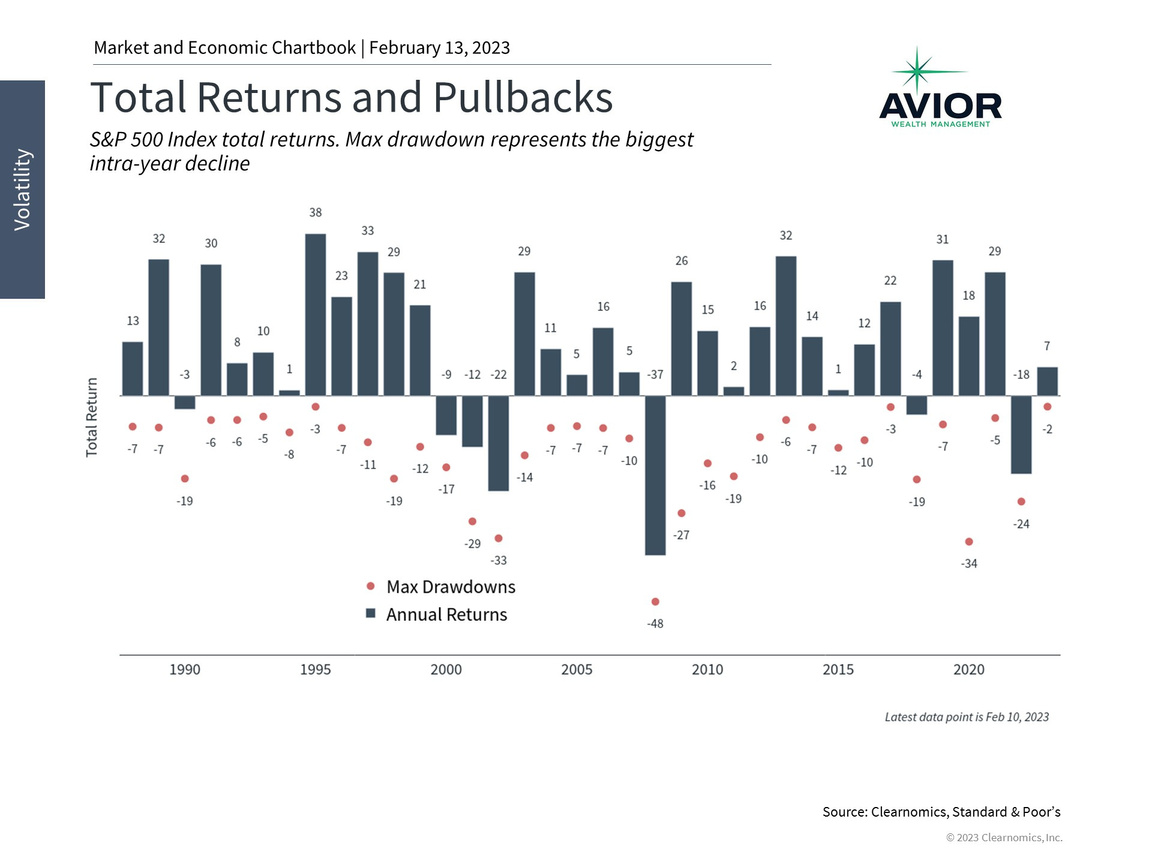

If history tells us anything about investing, it’s that markets never rise in a straight line. As much as all investors would prefer calm periods of steady returns, this simply isn’t how markets work. Instead, investors need to navigate alternating periods of exuberance and gloom, not only across the biggest bull and bear markets, such as the 2008 financial crisis and the decade-long expansion that followed, but also over shorter time frames such as the past year. History shows that focusing on broader patterns while anticipating short-term choppiness can increase the likelihood of achieving financial goals.

Shifts in investor sentiment occur because markets are forward-looking, try to anticipate unknown outcomes, and incorporate this information into prices today. In doing so, the market may often over- or undershoot, leading to swings which are often to the downside. Of course, many investors know this all too well after experiencing the last three years. What’s unfortunate is that this has led some to become discouraged which, in the worst case, may lead them to be poorly positioned for future opportunities.

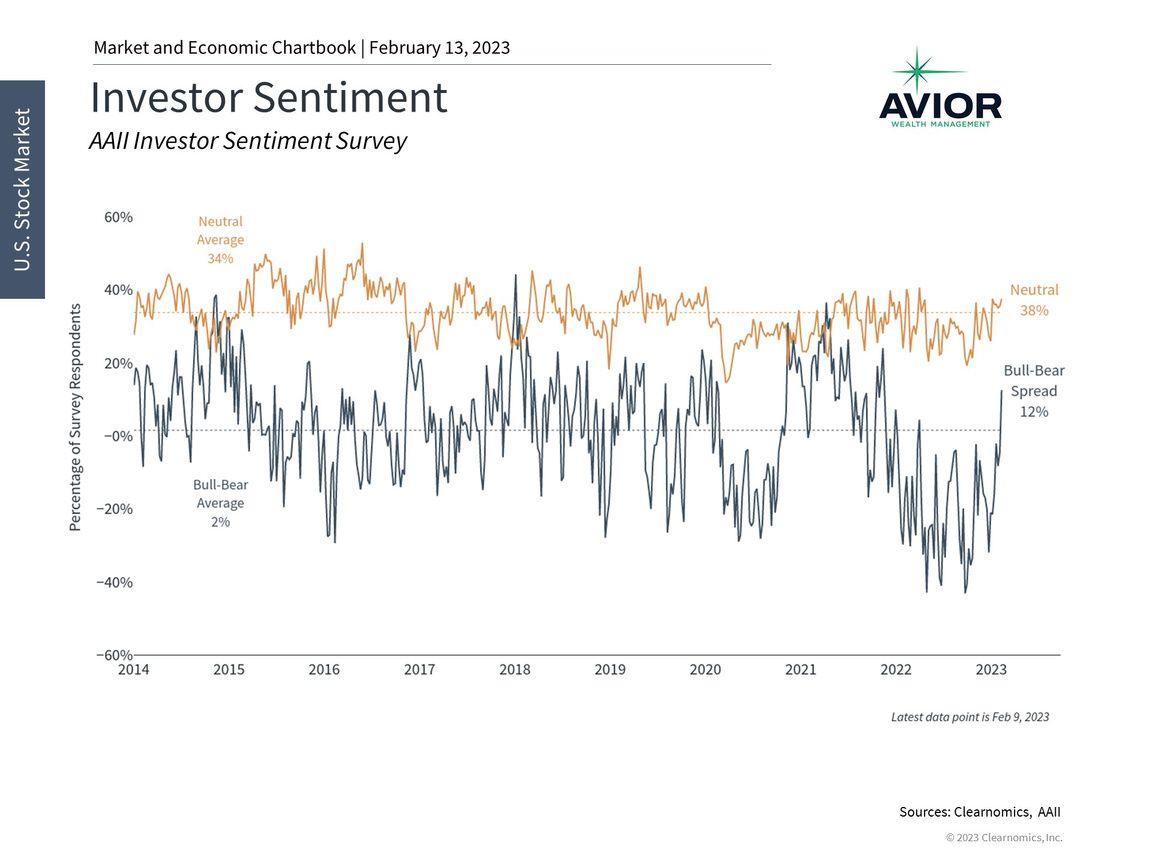

Investor sentiment is beginning to improve

However, there are signs that investor sentiment is now improving after falling to historic lows last year. Until recently, poor investor sentiment was partly driven by big issues such as a historic inflationary environment that hasn’t been seen in over 40 years, the possibility of a recession, and the risk of a policy mistake by the Fed. However, it was also driven by large reversals in areas such as tech, crypto, and consumer discretionary spending, frustrating many investors who chased short-term gains.

Thus, how many feel about markets is often driven by what the market has recently done. The latest data from the AAII Investor Sentiment Survey show that while 38% of respondents are neutral on the stock market, bullish attitudes are now outpacing bearish ones by 12%. This is no doubt driven by the improved market environment over the past few months, during which the S&P 500 has climbed 14% since October. In this way, sentiment is often a backward-looking indicator.

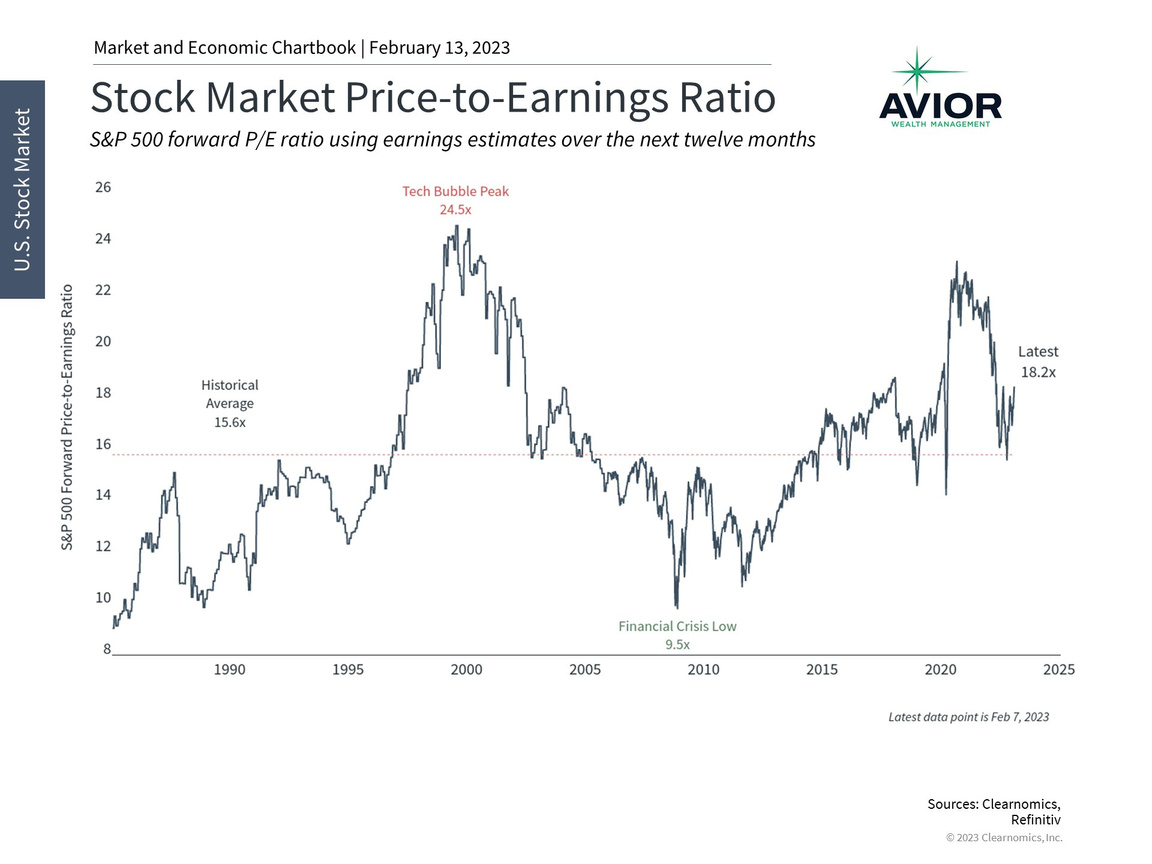

Valuations are still below their recent peaks

Another important metric that can be interpreted as a measure of sentiment is the valuation of the broad stock market. In particular, the price-to-earnings ratio of the S&P 500 currently sits at 18.2 times next-twelve-month earnings. This means that investors are willing to pay $18.2 for every dollar of anticipated earnings over the next year. This is above the historical average of 15.6, but well below the recent peak of 23.1.

In other words, investors are by no means bearish, but are clearly more cautious than they were in 2021 when all asset classes were rallying. This is positive for long-term investors because it means they can invest at a discount compared to just a year ago.

What’s more, recent data generally support this improved level of sentiment since the underlying economic trends are moving in the right direction. This includes better inflation figures, a job market that is still exceptionally strong, and a Fed that may pause its rate hikes soon. However, uncertainty remains due to the possibility of flat growth this year and the direction of core inflation.

Markets are performing very differently this year than in 2022

It’s clear that investors can be fickle and how they feel about the economy and markets can swing wildly on any given day. Learning to deal with uncertainty and to stay invested even when markets feel uncomfortable is an important part of any investor’s financial education. Perhaps counterintuitively, having the discipline to invest when others are still fearful can help to lay the groundwork for future financial success.

The bottom line? Investor sentiment is improving due to the rally of the past few months. Long-term investors ought to remain focused and remember to not get caught off guard by short-term swings.

Disclosure: This report was obtained from Clearnomics, an unaffiliated third-party. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.avior.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments.

Avior Wealth Management, LLC, 14301 FNB Pkwy, Suite 110, Omaha, Nebraska 68154, United States, 402-218-4064

No Comments

Sorry, the comment form is closed at this time.