AVIOR INSIGHTS – Why the Fed Raised Rates Amid a Banking Crisis

In this market environment, investors have had no choice but to balance a number of difficult issues related to the tightening of financial conditions. These have ranged from rising rates to a slowing economy, and a housing market downturn to the current banking crisis. While each of these issues has its own unique circumstances, it’s also important to recognize the common underlying causes. This is especially important as the situation evolves and the financial system continues to adjust to Fed rate hikes. What do investors need to know about tightening financial conditions as they stay invested for the long run?

At its recent March meeting, the Fed announced that it would raise rates another 25 basis points, pushing the fed funds rate to a range of 4.75% to 5.00%. They did this in spite of the recent runs on banks, reiterating that “the U.S. banking system is sound and resilient. Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation”.

In other words, the Fed’s view is that the problems in the banking industry will naturally tighten conditions, reducing the need for larger rate hikes. Despite the many calls for the Fed to cut rates, part of the Fed’s calculus is likely that overreacting to these banking problems would spark more panic, not less.

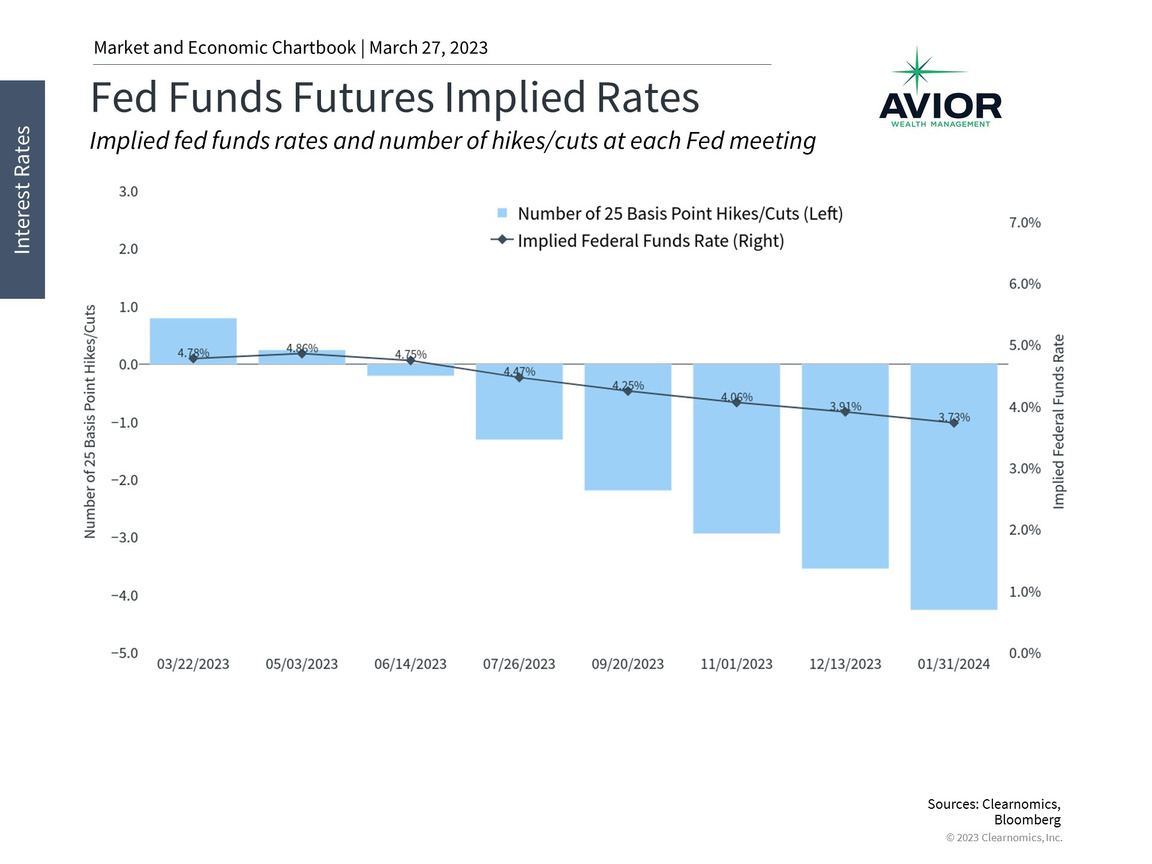

Markets expect the Fed to cut rates later this year

The Fed also published its Summary of Economic Projections which showed that officials expect growth to slow to 0.4% in 2023, unemployment to rise to 4.5% (from 3.6% today), and PCE inflation to decelerate to 3.3% (from 5.4% today). Fed officials also expect the fed funds rate to rise by another 25 basis points and remain there the rest of the year.

This is at odds with what the market expects. Fed funds futures show that investors believe the Fed might hike again in May, but will need to begin cutting rates soon after. Over the past year, the market has arguably been ahead of the Fed. Thus, despite what the Fed might do in the coming months, it is likely that we are in the midst of an inflection point in financial conditions. It should be noted that both the European Central Bank and the Bank of England also raised rates recently, although they face much more severe inflation challenges.

Since the Fed began hiking rates to fight inflation a year ago, many economists have worried about financial stability and the possibility of a recession. Many episodes over the past century, including the Great Depression and the mid-2000s housing bubble, show that the Fed tends to be reactive – that is, it often keeps policy conditions too loose for too long before then tightening aggressively. This is partly because the Fed only has blunt tools at its disposal that operate with a lag. It’s also because the Fed relies on broad economic indicators which are only published monthly or quarterly, with an eye toward the factors that caused the last crisis.

This has a number of implications today. On the one hand, the probability of a “soft landing” is still highly dependent on inflation, the labor market, and economic growth, just as it has always been. When it comes to inflation, there are many positive trends. For the most part, inflation rates are improving and some measures, such as goods inflation and core inflation excluding shelter, are already at or near the Fed’s target. For investors, markets have also performed better this year across stocks and bonds compared to 2022 due to reduced inflation risks.

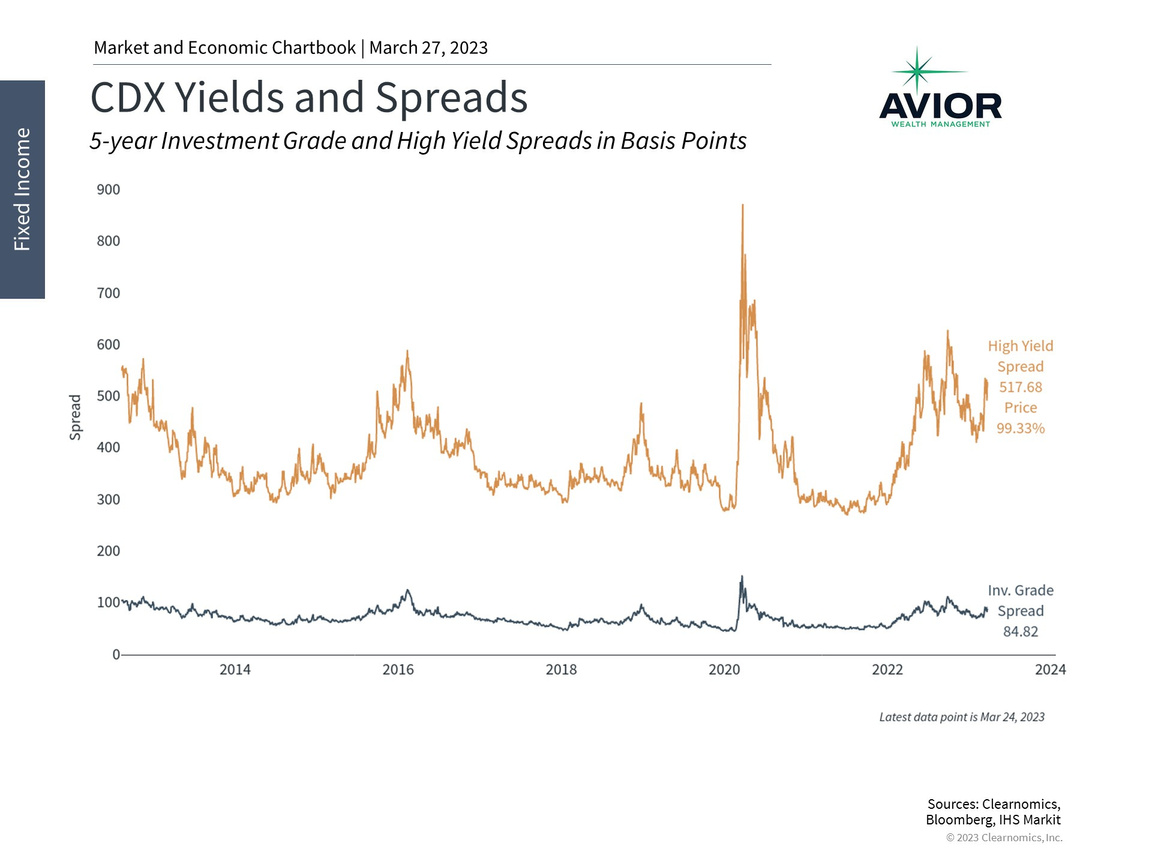

CDX spreads have only widened slightly

On the other hand, it can be argued that the economy is experiencing a hangover from the easy money policies of the past 15 years. Loose monetary policy can spur asset bubbles, and this arguably occurred in startups, tech and crypto, with the benefit of hindsight. The popping of these bubbles is necessary and healthy, but has near-term repercussions across the financial system. This echoes historical episodes during which Fed rate hike cycles led to financial instability whether in banks or across companies and countries that depend on cheap financing. A decade ago, for instance, a group of emerging market countries that were dependent on external capital, known as the “fragile five,” ran into problems when the Fed began to tighten conditions.

Thus, the current banking crisis is only one of the repercussions as the monetary tide has gone out. While this is still playing out and it’s unclear how at-risk regional banks and large European banks may ultimately fare, the situation has also stabilized. The first wave of panic that drove depositors away from these banks appears to be subsiding, and every day that passes should bring more calm.

To gauge whether this is the case, investors are closely watching spreads on credit default swaps – financial instruments used to track and hedge default risk. As expected, these spreads widened for at-risk banks, but at the moment are still within manageable levels. The accompanying chart of the CDX index – a benchmark of default risk across companies – shows an uptick, but levels are still well below 2020 and 2022, especially for the highest-quality issuers.

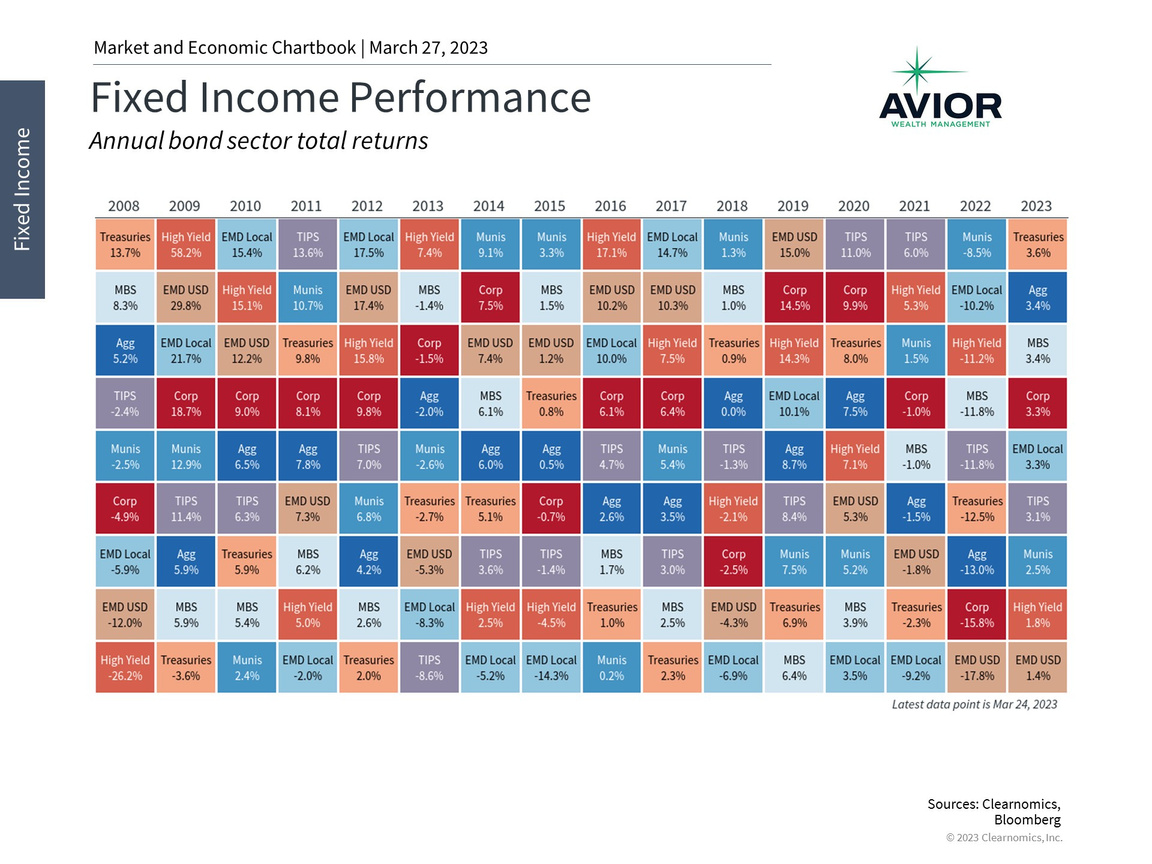

Fixed income has helped to stabilize portfolios this year

What does this mean for investors? Within the S&P 500, regional bank stocks have struggled, falling 34% year-to-date and the broader financials sector has declined 9.4%. Meanwhile, the broader S&P 500 has gained 3.4%. This is because sectors such as Information Technology and Communication Services have risen 17.5% and 18.4%, respectively, over this same period. Market swings have been more pronounced throughout this episode, but it goes to show the importance of staying diversified both across and within markets.

An important driver of the gains in these sectors has been the decline in interest rates, despite ongoing Fed rate hikes. This has helped re-establish the negative correlation between stocks and bonds that have helped long-term investors for over four decades. Throughout the challenges this year, a diversified basket of fixed income securities has gained 3.4%, driven by Treasuries, mortgage-backed securities, corporate debt, and more. This is a reminder that diversified investors with a focus on longer time horizons are more likely to stay on track, with a much steadier ride, than those that overreact to every new headline.

The bottom line? Despite the big market and financial events this year, the best course of action is still to stick to well-constructed portfolios and financial plans.

Disclosure: This report was obtained from Clearnomics, an unaffiliated third-party. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.avior.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments.

Avior Wealth Management, LLC, 14301 FNB Pkwy, Suite 110, Omaha, Nebraska 68154, United States, 402-218-4064

No Comments

Sorry, the comment form is closed at this time.