How Expectations Around the Fed, Banks, and the Economy Affect Investors

When it comes to markets, day-to-day price swings are often more about what investors expect than the underlying facts. This is because markets are designed to anticipate future events and assign them a price today. This gap between reality and expectations has driven stock and bond market volatility in recent days due to the Fed’s latest announcement and headlines in the banking sector. What should investors know about these developments to stay focused on the long run?

Rapid Fed rate hikes created stress for bonds, commercial real estate, and banks

First, the Fed announced on January 31 that it is keeping rates steady and closed the door on additional rate hikes. However, they also stated that the FOMC would need “greater confidence that inflation is moving sustainably toward 2 percent” before cutting rates, and Chair Jay Powell emphasized at his press conference that a rate cut is unlikely at its next meeting in March. This led to a shift in market expectations around the beginning of rate cuts, leading the S&P 500 to close 1.6% lower.

However, this was then followed by positive returns of 1.2% and 1.1% on the next two days as markets quickly adjusted. At the moment, markets have downgraded the path of policy rates by one cut, expecting a total of four or five by year end. Clearly, this is a case of the market getting ahead of itself with lofty rate cut expectations. The gap between what the Fed has previously communicated – possibly three cuts this year – versus what the market anticipates, is an ongoing source of market uncertainty.

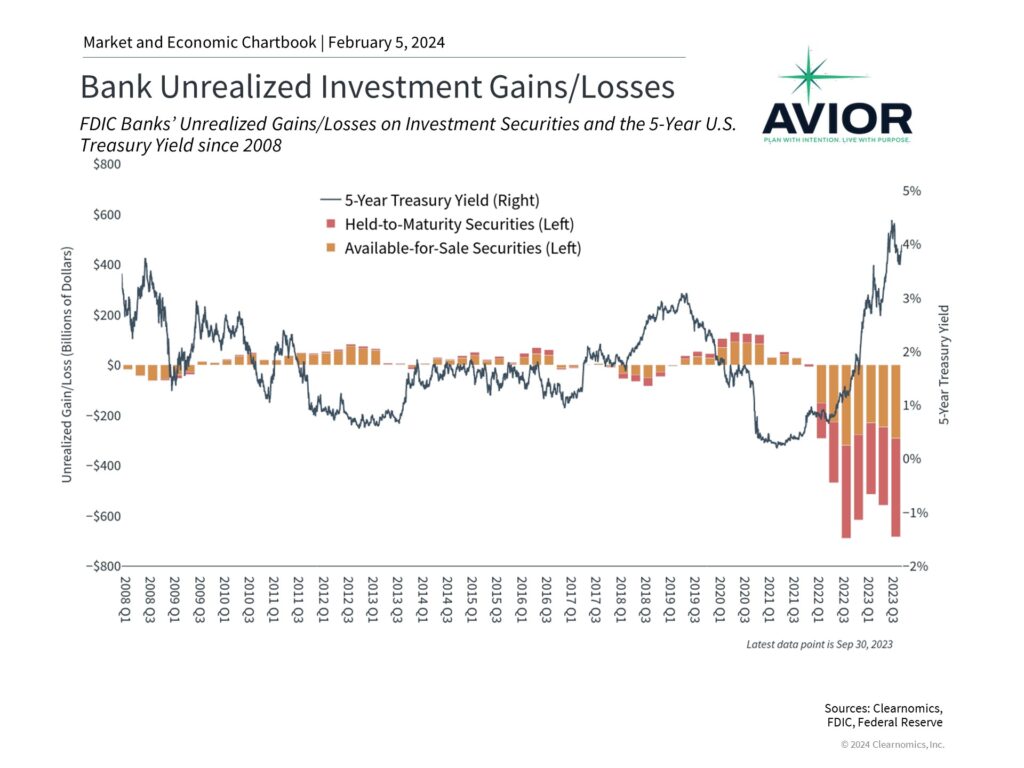

Second, the latest worry on investors’ minds is New York Community Bank (NYCB) and its deteriorating commercial real estate loan portfolio. Last year, NYCB acquired $38 billion in assets and assumed $36 billion in liabilities from Signature Bank which failed during the banking crisis. The accompanying chart shows the unrealized losses in bank bond holdings that helped to spark last year’s crisis along with a slowing economy and the crash in cryptocurrencies in 2022. The other banks that made headlines were Silicon Valley Bank and First Republic which were acquired by First Citizens Bank and JPMorgan, respectively.

While the banking sector has stabilized since then, commercial real estate has continued to struggle especially in the office and multifamily segments which make up a significant portion of NYCB’s loan portfolio. Their acquisition of Signature Bank assets also pushed NYCB above $100 billion which means it is subject to higher capital and liquidity requirements. Combined, NYCB reported a significant and unexpected quarterly loss.

Naturally, investors are worried about a repeat of last year’s bank failures. While the situation is still developing, the issues facing NYCB can be characterized as a continuation of the problems that Signature Bank faced due to higher interest rates and a slowing economy. This means that it’s possible for these issues to be bank-specific rather than reflect problems across the entire financial system. Indeed, while the regional banks sub-industry of the S&P 500 has fallen 2.4% this year, the broader financials sector has risen about 3.5%.

The job market is still historically strong

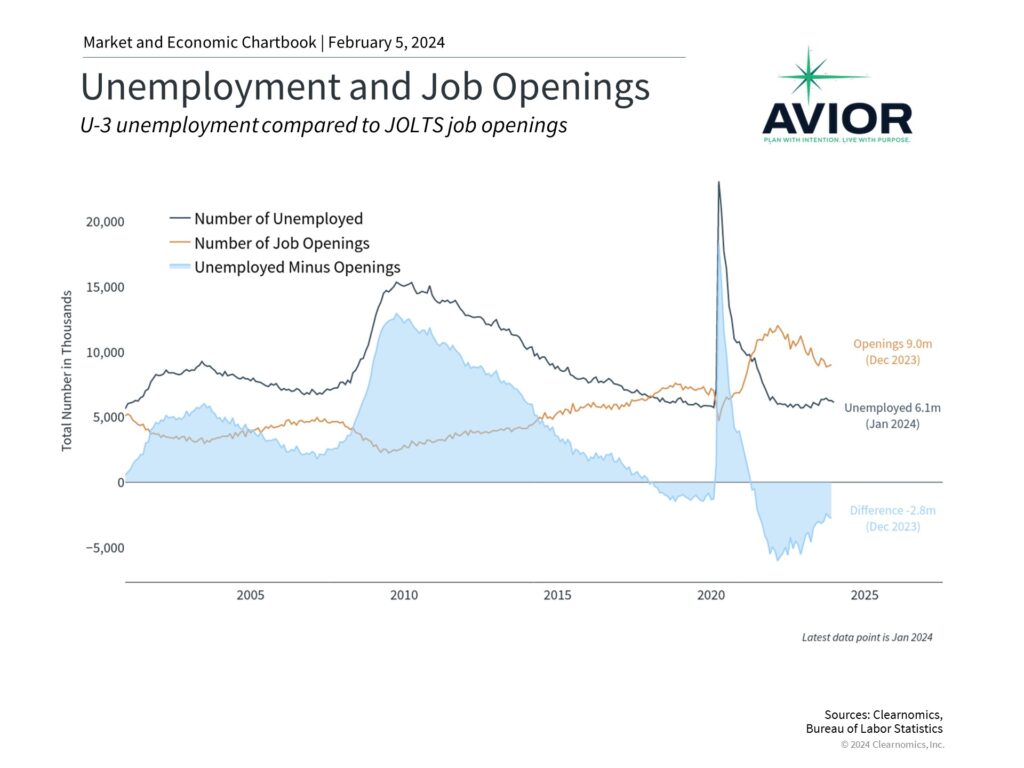

In contrast to many of these investor concerns, there are many signs that the economy is fundamentally strong. The latest jobs report showed that 353,000 new jobs were created in January, far more than the 185,000 economists expected. December payrolls were also revised up sharply to 333,000, bringing the average monthly gain over the past year to 244,000, a very healthy pace. The unemployment rate remains at 3.7%, one of the lowest in history. The accompanying chart shows that while job openings have declined as the Fed has raised rates, there are still nearly 1.5 job openings per unemployed person across the country.

This is the case despite layoff announcements from large companies as they attempt to reduce costs and maintain profit margins. Many of these layoffs are a reversal of the rapid hiring that occurred during and after the pandemic, especially among large technology companies such as Alphabet, Microsoft, PayPal and many others. While these layoffs clearly have an impact on individuals and households, perspective is needed when considering the effects on the economy and markets. The jobs data show that while the Information sector gained “only” 15,000 jobs last month, sectors such as Professional and Business Services, Health Care, and Retail Trade added 74,000, 70,000, and 45,000, respectively.

Despite recent market swings, volatility remains subdued

Thus, there is always both good and bad news that must be weighed by investors. It’s often the case that as events unfold, markets settle, and expectations converge on reality. Interestingly, the accompanying chart shows that the VIX index, a measure of stock market volatility, is still fairly subdued despite recent events. Investors should continue to anticipate and prepare for market uncertainty by staying diversified and focused on the long run.

The bottom line? Recent events around the Fed and banking sector have led to market swings. Investors should continue to stay focused on the long run and not overreact to daily headlines.

Disclosure: This report was obtained from Clearnomics, an unaffiliated third-party. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.aviorwealth.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. Please remember to contact Avior, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, or modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian. A copy of our current written disclosure Brochure and Form CRS (Customer Relationship Summary) discussing our advisory services and fees continues to remain available upon request or at www.avior.com.

No Comments

Sorry, the comment form is closed at this time.