AVIOR INSIGHTS – Why Underlying Market Drivers Matter More Than Daily Price Swings

However, focusing on performance alone misses what really matters. This is because it’s underlying factors such as interest rates, commodities, and the U.S. dollar that are truly driving markets. In some cases, this is due to real financial and economic data, such as the Consumer Price Index, GDP and the supply of oil and gas. In other cases, it’s due to changes in market expectations, such as with projected Fed policy rates. In either case, focusing on these underlying measures is far more important than watching the day-to-day headlines on what the market has already done. Among these many factors, there are at least three that will continue to matter to long-term investors.

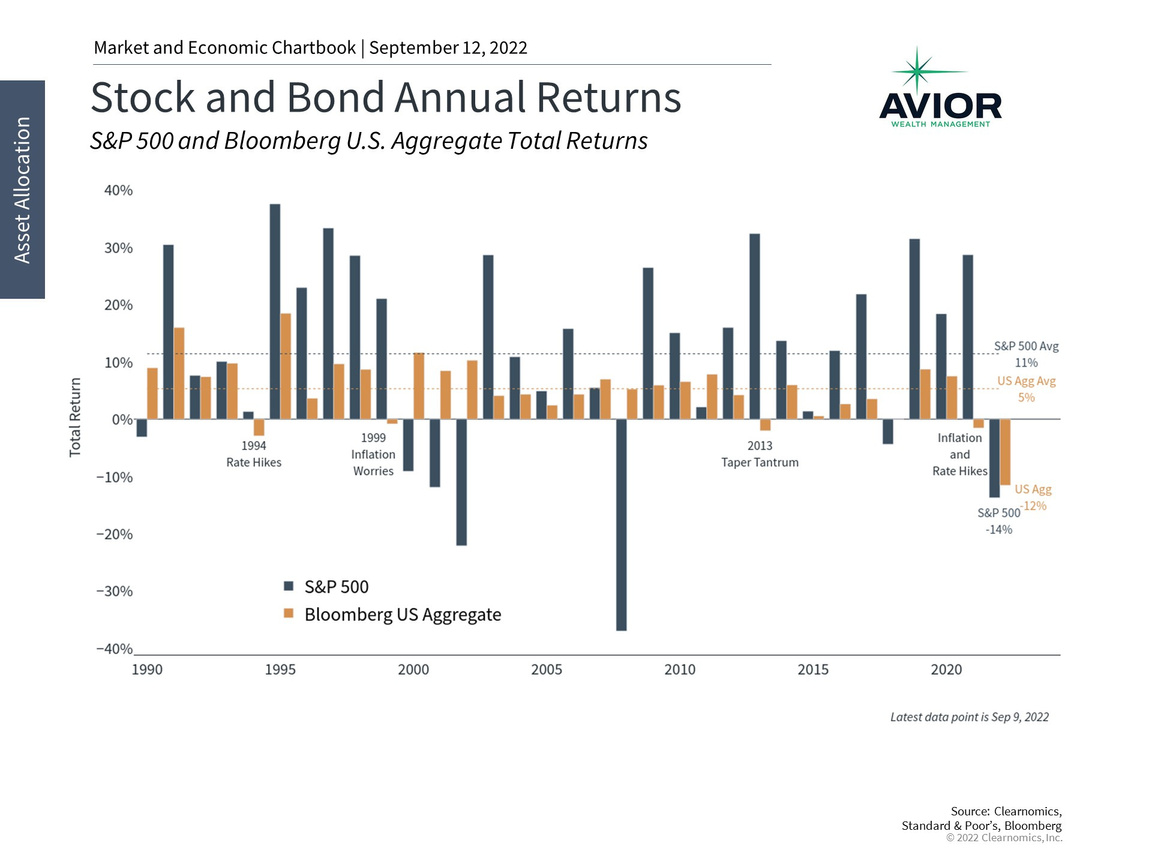

Stocks and bonds have both fallen due to rising rates

At the same time, rates have not risen in a straight line. Like the broader market, they have climbed in fits and starts, with the most dramatic taking place from March to June when the 10-year Treasury yield rose from 1.7% to almost 3.5%. Rates have bounced around since then and are still below their June peaks. It’s not just rising rates that matter – it’s whether investors expect them. An important driver of the June to August recovery was that markets had not only digested the path of Fed rate hikes, but supported this policy in order to fight inflation. This matters because investors who overreacted during periods of market volatility throughout the year would most likely have missed the inevitable rebounds.

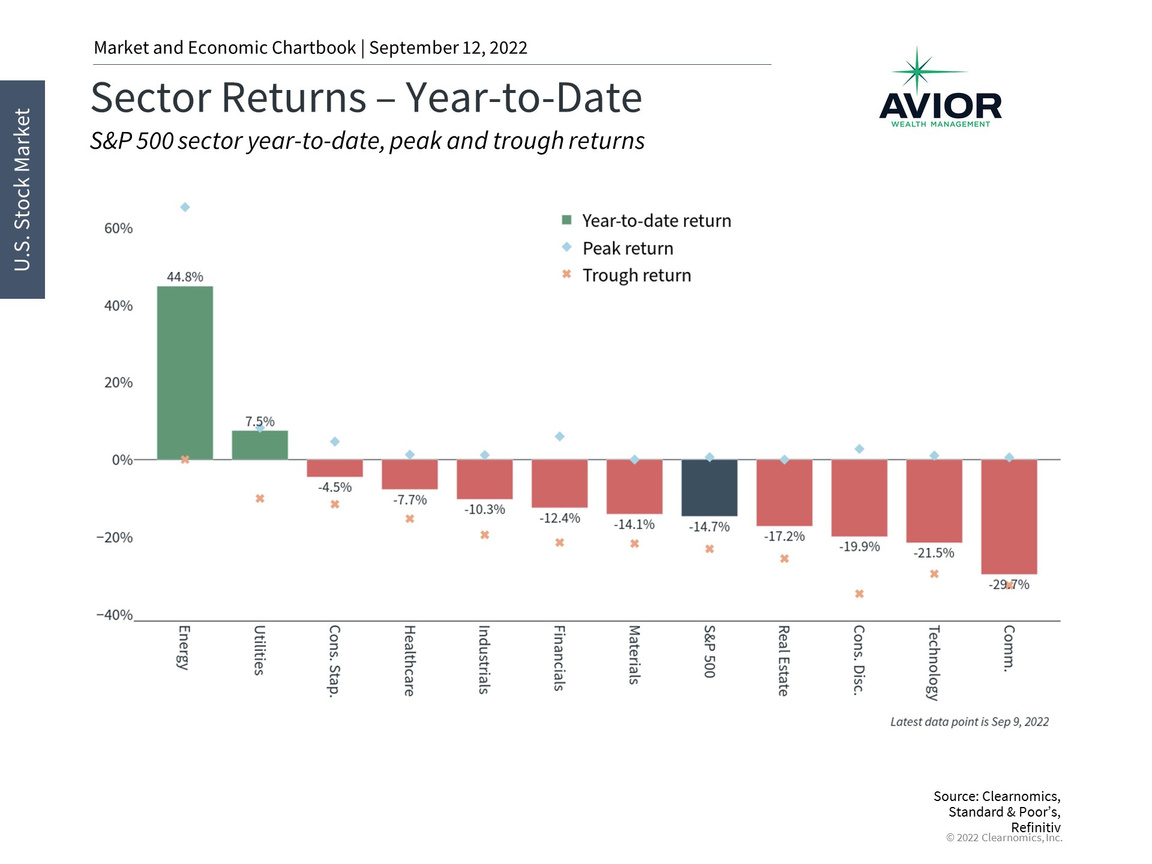

There has been wide dispersion between sectors

These swings in commodities prices have also driven significant dispersion among S&P 500 sectors this year. 9 of the 11 sectors are in the red with the Communication Services and Information Technology sectors performing the worst with declines of 29.7% and 21.5%, respectively. In contrast, Energy and Utilities have yielded positive returns this year of 44.8% and 7.5%, respectively. The interaction between commodities, inflation and interest rates have helped these sectors at the expense of former tech high-fliers that are sensitive to rates. Still, many of the worst-performing sectors have already rebounded off their lows.

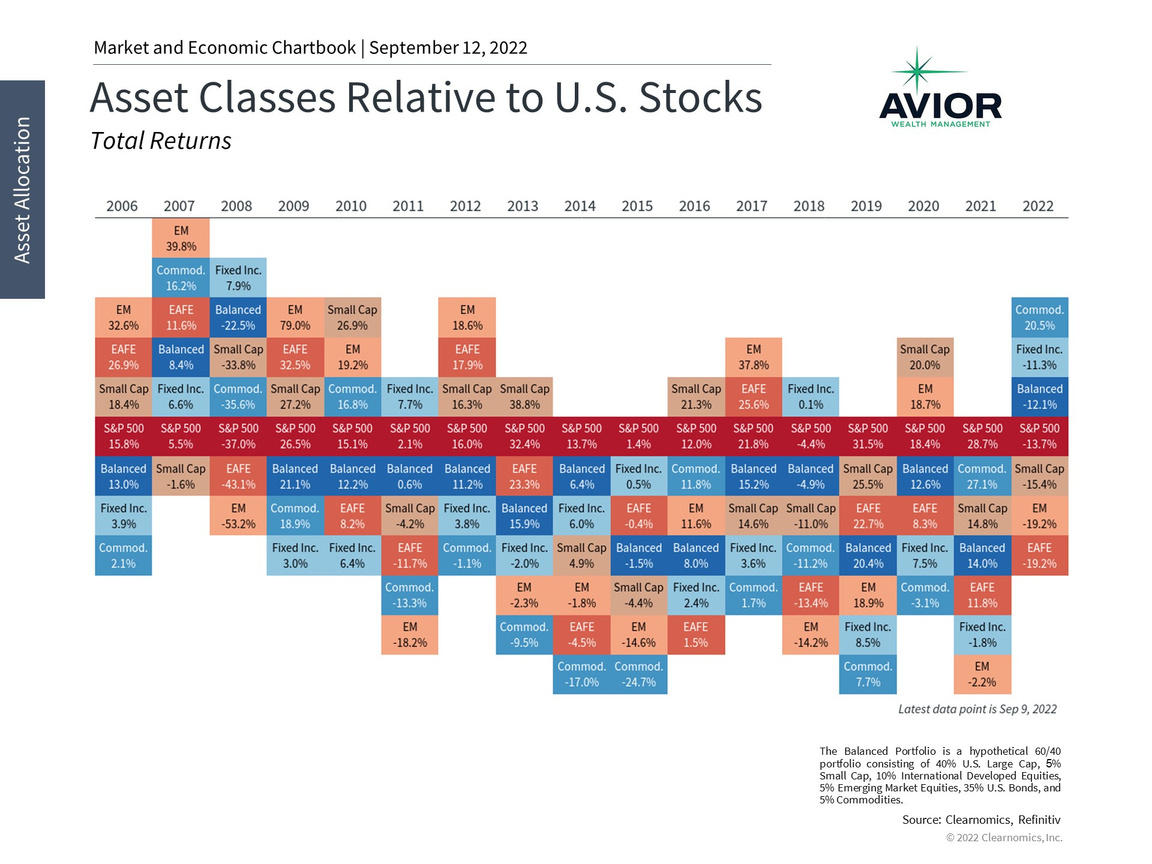

Global stocks have struggled due to the dollar

Third, the strong U.S. dollar both slows the economy and is a drag on international stock markets for U.S.-based investors. The dollar has strengthened significantly this year due to tighter Fed policy and the relative strength of the U.S. economy. A rising dollar can be a headwind for U.S.-based investors since the foreign currencies used to buy international assets weakens, reducing total returns. The MSCI Developed Market index, for instance, has experienced a total return of -6% this year in local currency terms but -19% in dollar terms. For the MSCI Emerging Markets index, these numbers are -16% and -19%, respectively.

However, currencies tend to mean-revert over time. The dollar is now at its strongest level in twenty years, with the Euro still hovering around parity, and there are early signs that it could turn around. Additionally, if the main economic challenge is inflation, a strong dollar can be good news. For American travelers and consumers buying foreign goods, the dollar will go much further. So, like interest rates and commodities, investors should not overreact to the dollar at current levels. If it were to reverse or drive inflation lower, this could become a tailwind to international investments and global markets overall.

The bottom line? Investors should focus on the underlying drivers of markets rather than stock prices alone. The factors that have driven markets this year continue to evolve and require that investors not overreact. Staying diversified and maintaining a long time horizon are still the best ways to achieve financial goals.

Avior Wealth Management, LLC, 14301 FNB Pkwy, Suite 110, Omaha, Nebraska 68154, United States, 402-810-7831

No Comments

Sorry, the comment form is closed at this time.